sarahtpoetess.ru

Overview

Price Of Johnson & Johnson

Real time Johnson & Johnson (JNJ) stock price quote, stock graph, news & analysis. The current price of JNJ is $ The 52 week high of JNJ is $ and 52 week low is $ When is next earnings date of Johnson & Johnson(JNJ)?. The. Johnson & Johnson JNJ:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/28/23 · 52 Week Low Valuation: Johnson & Johnson. (USD). Capitalization, B, P/E ratio *. 21x. P/E ratio *, x. Enterprise value, B, EV / Sales *. x. EV. Johnson & Johnson (JNJ) - Price History ; August , $, $ ; July , $, $ ; June , $, $ ; May , $, $ Looking to buy Johnson & Johnson Stock? View today's JNJ stock price, trade commission-free, and discuss JNJ stock updates with the investor community. Johnson & Johnson · AT CLOSE PM EDT 08/27/24 · USD · % · Volume4,, Discover real-time Johnson & Johnson Common Stock (JNJ) stock prices, quotes, historical data, news, and Insights for informed trading and investment. J&J stock price quote (NYSE: JNJ), historical charts, related news, stock analyst insights and more to help you make the right investing decisions. Real time Johnson & Johnson (JNJ) stock price quote, stock graph, news & analysis. The current price of JNJ is $ The 52 week high of JNJ is $ and 52 week low is $ When is next earnings date of Johnson & Johnson(JNJ)?. The. Johnson & Johnson JNJ:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/28/23 · 52 Week Low Valuation: Johnson & Johnson. (USD). Capitalization, B, P/E ratio *. 21x. P/E ratio *, x. Enterprise value, B, EV / Sales *. x. EV. Johnson & Johnson (JNJ) - Price History ; August , $, $ ; July , $, $ ; June , $, $ ; May , $, $ Looking to buy Johnson & Johnson Stock? View today's JNJ stock price, trade commission-free, and discuss JNJ stock updates with the investor community. Johnson & Johnson · AT CLOSE PM EDT 08/27/24 · USD · % · Volume4,, Discover real-time Johnson & Johnson Common Stock (JNJ) stock prices, quotes, historical data, news, and Insights for informed trading and investment. J&J stock price quote (NYSE: JNJ), historical charts, related news, stock analyst insights and more to help you make the right investing decisions.

Get today's JNJ stock price and latest Johnson & Johnson stock news as well as JNJ real-time stock quotes, technical analysis, full financials and more. JNJ Stock Overview ; GO. Goran_Damchevski. Equity Analyst ; Summary of all time highs, changes and price drops for Johnson & Johnson. Historical stock prices ; Joe Biden hails $bn savings after striking Big Pharma drug price deal. Administration claims victory in talks to cut the costs of 10 critical medicines. Johnson & Johnson JNJ Overview. Ranked in Defensive Picks and 3 other price (usd). (%). daily change. 52 week low. 52 week high. JNJ. Price, $, Volume, 2,, Change, +, % Change, +%. Today's open, $, Previous close, $ Intraday high, $, Intraday low. Price/Earnings ttm · Earnings Per Share ttm · Most Recent Earnings $ on 07/17/24 · Next Earnings Date 10/15/24 · Annual Dividend & Yield ( Stock price for similar companies or competitors ; Johnson & Johnson Logo. Merck. MRK. $, %, USA ; Johnson & Johnson Logo. Novartis. NVS. $ The current price of JNJ is USD — it has increased by % in the past 24 hours. Watch Johnson & Johnson stock price performance more closely on the. The 82 analysts offering price forecasts for Johnson & Johnson have a median target of , with a high estimate of and a low estimate of Johnson & Johnson ; Median, $ ; Low, $ ; Average, $ ; Current Price, $ ; Estimate, Discover historical prices for JNJ stock on Yahoo Finance. View daily, weekly or monthly format back to when Johnson & Johnson stock was issued. Johnson & Johnson ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $B. View the real-time JNJ price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. In depth view into JNJ (Johnson & Johnson) stock including the latest price, news, dividend history, earnings information and financials. Historical daily share price chart and data for Johnson & Johnson since adjusted for splits and dividends. Previous close. The last closing price. $ ; Year range. The range between the high and low prices over the past 52 weeks. $ - $ ; Market cap. A. Johnson & Johnson (JNJ) has a Smart Score of 10 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. Get Johnson & Johnson (JNJ.N) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. The intrinsic value of one JNJ stock under the Base Case scenario is USD. Compared to the current market price of USD, Johnson & Johnson is. Johnson & Johnson ; Market Cap. $B ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share.

Most Veteran Friendly Companies

#1 USAA · #2 Verizon · #3 Lowe's Companies Inc. · #4 Hilton · #5 Windstream Holdings · #6 COMCAST · #7 Navient Solutions · #8 Wells Fargo. There are many resources available to help veterans looking for employment and those who are unemployed. Top Employers of Military Veterans · Snap-On Tools · Mathnasium Learning Centers · Anytime Fitness · BIGGBY Coffee · UPS Store · Dream Vacations · Visiting Angels. U.S. Veterans Magazine has named Atlantic Diving Supply one of the nation's Top 25 veteran-friendly defense contractors. DESIGNATION: Military Friendly Employers · 7-Eleven, Inc. · 7G Environmental Compliance Management · AAR CORP · ADP · ADS, Inc. · AECOM · AMERICAN SYSTEMS · APVantage. Local Veterans Employment Representative (LVER) conducts employer outreach to promote to employers the advantages of hiring veterans. LVER staff also plan and. Recently Added to sarahtpoetess.ru's List of Employers Hiring Veterans. This web site can assist you with your transition to civilian life, link you with military friendly businesses, provide education and intern opportunities. Atlanta Electric, LLC received the Gold Standard Veteran Friendly Employer Recognition on March 14, Atlantic Electric, LLC is located in Charleston South. #1 USAA · #2 Verizon · #3 Lowe's Companies Inc. · #4 Hilton · #5 Windstream Holdings · #6 COMCAST · #7 Navient Solutions · #8 Wells Fargo. There are many resources available to help veterans looking for employment and those who are unemployed. Top Employers of Military Veterans · Snap-On Tools · Mathnasium Learning Centers · Anytime Fitness · BIGGBY Coffee · UPS Store · Dream Vacations · Visiting Angels. U.S. Veterans Magazine has named Atlantic Diving Supply one of the nation's Top 25 veteran-friendly defense contractors. DESIGNATION: Military Friendly Employers · 7-Eleven, Inc. · 7G Environmental Compliance Management · AAR CORP · ADP · ADS, Inc. · AECOM · AMERICAN SYSTEMS · APVantage. Local Veterans Employment Representative (LVER) conducts employer outreach to promote to employers the advantages of hiring veterans. LVER staff also plan and. Recently Added to sarahtpoetess.ru's List of Employers Hiring Veterans. This web site can assist you with your transition to civilian life, link you with military friendly businesses, provide education and intern opportunities. Atlanta Electric, LLC received the Gold Standard Veteran Friendly Employer Recognition on March 14, Atlantic Electric, LLC is located in Charleston South.

U.S. Department of Labor VETS Regional Veterans' Employment Coordinators (RVECs) work to help employers find service members, veterans, and military spouses. many employers with so many different job opportunities. With more than million veterans, Florida is the most veteran-friendly state in the nation. Fortune World's Most Admired Companies award. Fortune World's Best of the Best Top Veteran-Friendly Companies, U.S. Veterans Magazine. Hiring military veterans has proven to be a successful strategy; in addition to gaining high-performing employees with low turnover, companies generally earn. Working a Federal Government job is one of the most veteran friendly jobs that can be found in America. It is a great career path with amazing benefits. The company I work for (spectrum/charter) is one of the most veteran friendly employers in the country. Veterans resource groups and support. G.I. Jobs magazine created the Military Friendly Employer designation to recognize companies that have great programs and opportunities for veterans and. military-specific code into BAE Systems jobs and then apply to the most applicable position. In , a production team was invited to the Nashua campus to. A military hiring network, sarahtpoetess.ru is a powerful resource to connect you with veteran-friendly employers. After posting your resume on the site, you. Veteran and Military Spouse Employers · USAA · Home Depot · Lockheed Martin · Comcast · Worthington Enterprises · CVS Health · Worthington Steel · General Mills. Companies Hiring Veterans · Alphabet · Amazon · Boeing · Dell · IBM · Liberty Mutual Insurance · Meta · Microsoft. Veteran Committed Companies · WillScot · Axon · Workiva · Desert Financial Credit Union · Rocket Companies · KUBRA · Vensure · Northern Trust. Silver-Level Employers. Employment · For Veterans · Veteran-Friendly Employers. Silver-Level Employers. Aldevra Northgate Resorts operates one of the most. Most offices have specialized staff—all of whom are veterans military-friendly employers a comprehensive vehicle to recruit transitioning service members. most knowledgeable voices in the veteran employment space. VETS Indexes' evaluation compared employers' veteran-related policies, practices, and outcomes. Military Friendly - Best for Veterans Employers. ManTech has made this list of the nation's most military-friendly companies every year since Learn. veterans' employment award that recognizes employers Today's Veteran is one of the most highly-trained assets an employer can have in their workforce. Create Military-Friendly Job Descriptions. Improve veteran outreach by describing military-specific competencies and capabilities that translate to civilian. These employers hire veterans under the Work Opportunity Tax Credit (WOTC) program. Employers can receive up to a $9, tax credit by hiring a veteran. Tax. 1. Verizon – This company was not only ranked #1 on Military friendly in , it also funds many training and workforce nonprofit programs for.

My Nexplanon Expires In A Month

NEXPLANON must be inserted by the expiration date stated on the packaging. NEXPLANON is a long-acting (up to 3 years), reversible, hormonal contraceptive method. Beyond the expiration date, there's no guarantee that the IUD will work to prevent pregnancy. There's also a risk for infection if an IUD is left in for too. Nexplanon® is a highly effective, reversible birth control implant that can be used by people to prevent pregnancy for up to three years at a time. You can continue to use it until you reach the menopause, when a woman's monthly periods stop (at around 52 years of age). The implant can be removed at any. It is given by injection and repeat injections are approximately every 3 months. It prevents pregnancy by thickening the cervical fluid to keep sperm from. NEXPLANON must be inserted by the expiration date stated on the packaging. NEXPLANON is a long-acting (up to 3 years), reversible, hormonal contraceptive method. NEXPLANON® (etonogestrel implant) 68 mg Radiopaque is reversible and can be removed at any time. Learn more about pregnancy after the removal of NEXPLANON. Will it still protect me? The risk of getting pregnant in the year after an implant expires (during the 4th year of use) is very low. Even though. How long does the implant last and can you get pregnant on an expired Nexplanon / Implanon? Nexplanon can be used for three years, at which point it should be. NEXPLANON must be inserted by the expiration date stated on the packaging. NEXPLANON is a long-acting (up to 3 years), reversible, hormonal contraceptive method. Beyond the expiration date, there's no guarantee that the IUD will work to prevent pregnancy. There's also a risk for infection if an IUD is left in for too. Nexplanon® is a highly effective, reversible birth control implant that can be used by people to prevent pregnancy for up to three years at a time. You can continue to use it until you reach the menopause, when a woman's monthly periods stop (at around 52 years of age). The implant can be removed at any. It is given by injection and repeat injections are approximately every 3 months. It prevents pregnancy by thickening the cervical fluid to keep sperm from. NEXPLANON must be inserted by the expiration date stated on the packaging. NEXPLANON is a long-acting (up to 3 years), reversible, hormonal contraceptive method. NEXPLANON® (etonogestrel implant) 68 mg Radiopaque is reversible and can be removed at any time. Learn more about pregnancy after the removal of NEXPLANON. Will it still protect me? The risk of getting pregnant in the year after an implant expires (during the 4th year of use) is very low. Even though. How long does the implant last and can you get pregnant on an expired Nexplanon / Implanon? Nexplanon can be used for three years, at which point it should be.

NEXPLANON® (etonogestrel implant) 68 mg Radiopaque must be removed or replaced after 3 years of use. Learn more about the replacement process for NEXPLANON. NEXPLANON must be removed by the end of the third year and may be replaced by another NEXPLANON at the time of removal, if continued contraceptive protection is. The most common side effect of NEXPLANON is a change in your normal menstrual bleeding pattern. In studies, one out of ten women stopped using the implant. The implant lasts 3 years. Please book your next implant appointment 3 months before your implant runs out. You will be given a card with its expiry date on it. Nexplanon works for 5 years, and a nurse or doctor must remove it once it expires. You can also get your implant taken out any time before then if you want to. Once your Implant has expired after 3 years, you repeat this process if you desire to continue using an Implant. It is best if you do not leave your Implant. Dr Finikiotis is a gynaecologist but will see early pregnancy patients until the 3 rd Month. View Profile Doctors are taught to use " Evidence Based Medicine". The implant should be removed after 3 years even if you no longer require contraception. If a pregnancy occurs with an expired Implanon NXT® in place, then. In most cases, any changes to period bleeding will occur in the first 3 months after having Nexplanon inserted. These changes may continue as long as you have. You'll need to get the implant removed by a provider after 3 to 5 years, when it expires. The implant is safe and 99% effective in preventing pregnancy. It's. It is possible for you to get pregnant very soon after Nexplanon is removed. What happens during the procedure? You may be asked to take a pregnancy test before. What happens after three years if I want to continue to use Nexplanon after this device expires? · pus/bleeding at the insertion site · heavy vaginal bleeding. Nexplanon® can be used for up to 3 years. After 3 years the hormone supply runs out and the implant stops working, which means it must be removed. If you. It is very common to have bleeding after Nexplanon placement. Irregular bleeding can continue for months in some cases. The majority of patients continue to. Nexplanon is effective for up to 3 years of use. You should have your Nexplanon implant replaced at least once every 3 years. Your doctor can help you keep. With the implant, you can get pregnant as soon as it's removed. It may take 3 to 18 months after your last shot to get pregnant. The progestin-only pill, also. Like any hormonal contraceptive, Nexplanon can cause some side effects, which typically disappear after the first few months. These include mood changes, acne. Irregular bleeding is a common side effect and will usually settle down within 3 months. Whatever your bleeding pattern, the implant is still effective. If the. it is due to expire in 3 years. Tayside Sexual and Reproductive Health Service will not send you a reminder. The date when your implant needs to be replaced to.

Do You Need An Llc For A Business Credit Card

An Employer Identification Number (EIN) functions as a Social Security number for your business. You'll need one to open a business bank account or credit card. If you have already created a Limited Liability Corporation (LLC), then you can apply for a small business credit card using your EIN. But if you haven't. You also don't need to have an established business to get a credit card. Card issuers are often willing to consider businesses that aren't making any money yet. Preferred Rewards for Business makes your credit card even better. When you become a Preferred Rewards for Business member, you can get up to 75% more. What do you need to apply for a business credit card? · Your full name, residential address, date of birth, Social Security Number, and contact info · Your. You can certainly obtain business credit cards as a sole proprietor, but to get those larger lines of credit in the tens and hundreds of thousands range, most. If you form an LLC, any credit cards will be based on the personal credit history of the LLC member(s) and will almost certainly require the. Visa Spend Clarity for Business offers the automation and tools you need to keep your spend on track, allowing you to focus on growing your business. Do I Need a Business Credit Card? · A business credit card is vital in maintaining the separation of personal and business finances. · It establishes your. An Employer Identification Number (EIN) functions as a Social Security number for your business. You'll need one to open a business bank account or credit card. If you have already created a Limited Liability Corporation (LLC), then you can apply for a small business credit card using your EIN. But if you haven't. You also don't need to have an established business to get a credit card. Card issuers are often willing to consider businesses that aren't making any money yet. Preferred Rewards for Business makes your credit card even better. When you become a Preferred Rewards for Business member, you can get up to 75% more. What do you need to apply for a business credit card? · Your full name, residential address, date of birth, Social Security Number, and contact info · Your. You can certainly obtain business credit cards as a sole proprietor, but to get those larger lines of credit in the tens and hundreds of thousands range, most. If you form an LLC, any credit cards will be based on the personal credit history of the LLC member(s) and will almost certainly require the. Visa Spend Clarity for Business offers the automation and tools you need to keep your spend on track, allowing you to focus on growing your business. Do I Need a Business Credit Card? · A business credit card is vital in maintaining the separation of personal and business finances. · It establishes your.

You should get a business credit card as soon as you begin making regular, dedicated purchases on behalf of your business. To apply for and get a credit card with an LLC, you must be an owner, officer, or authorized representative of the LLC. Once approved, you can then, if you wish. Why would I need a small business credit card? A business credit card gives you the flexibility to finance purchases and streamline expenses for your small. credit by taking credit lines with banks and suppliers, and applying for business credit cards. Maintaining a good business credit history requires prompt. They are essential for LLCs as they help segregate personal and business expenses, improve financial management, and enhance the business's credit profile. Q. I have a personal credit card. Why do I need a Visa credit card for business? The best use of an LLC is to protect your other assets from risk. But, buying an Umbrella Insurance policy can be a better choice. An LLC has to have cash flow. Every card demands a different credit score–and even an excellent score doesn't guarantee approval. However, most rewards credit cards stipulate that you should. What information do I need for a business credit card application? When applying for a business credit card, you will need to provide both personal and. See what Brex can do for you. Get the spending power you want and the controls you need today. How do I apply for a Brex corporate credit card? How long does. Yes, keep your personal finances separate from your business finances. Pay your personal credit card from your personal checking account. Can an LLC get a credit card? Yes, LLCs can get credit cards. Approval for business credit cards largely depends on the personal credit of the applicant, not. Starting an LLC gives your business the opportunity to pay vendors, utilities, credit cards, and loans on time, which will help to build your LLC's credit score. Why should I get a credit card for my business? Do I Need a Business Credit Card? · A business credit card is vital in maintaining the separation of personal and business finances. · It establishes your. Starting an LLC gives your business the opportunity to pay vendors, utilities, credit cards, and loans on time, which will help to build your LLC's credit score. While you can very easily finance your business with a home equity loan, credit card, or an individual unsecured loan, you should know that overall costs would. Do I need a business credit card for an LLC? You don't need a business credit card if you run any sort of business, but it could provide you with multiple. Yes, you can apply for some business credit cards without an EIN, but not all credit cards will accept you. Learn more about applying for a business credit. The application process is generally straightforward but does require a credit check and proof of business ownership. Business credit cards also usually require.

Can I Work Part Time And Collect Social Security

There's a limit on how much you can earn and still receive your full Social Security retirement benefits while working. Some people who file for benefits. If you are working when you apply for disability benefits and you earn over the SGA limit, your application will likely be denied. In addition, earning lower. You can get Social Security retirement benefits and work at the same time before your full retirement age. However your benefits will be reduced. Continued earnings could increase your Social Security benefit depending on your situation. One thing is for sure: working part-time at reduced pay will never. However, you will receive benefits for a longer period. If you collect before your full retirement age, there are income limits if you decide to work. Social. Yes, you can work part-time on Social Security Disability as long as your income does not exceed the allowable income limits set by the Social Security. Yes, you can get Social Security retirement and work. If you are at full retirement age or older, you keep all of your retirement benefits, no. You can work and collect Social Security benefits at the same time. However, the dollar amount of your monthly check is sometimes temporarily reduced. You must earn at least 40 Social Security credits to be eligible for Social Security benefits. You earn credits when you work and pay Social Security taxes. There's a limit on how much you can earn and still receive your full Social Security retirement benefits while working. Some people who file for benefits. If you are working when you apply for disability benefits and you earn over the SGA limit, your application will likely be denied. In addition, earning lower. You can get Social Security retirement benefits and work at the same time before your full retirement age. However your benefits will be reduced. Continued earnings could increase your Social Security benefit depending on your situation. One thing is for sure: working part-time at reduced pay will never. However, you will receive benefits for a longer period. If you collect before your full retirement age, there are income limits if you decide to work. Social. Yes, you can work part-time on Social Security Disability as long as your income does not exceed the allowable income limits set by the Social Security. Yes, you can get Social Security retirement and work. If you are at full retirement age or older, you keep all of your retirement benefits, no. You can work and collect Social Security benefits at the same time. However, the dollar amount of your monthly check is sometimes temporarily reduced. You must earn at least 40 Social Security credits to be eligible for Social Security benefits. You earn credits when you work and pay Social Security taxes.

Even if you just have a part-time job or some consulting income, your paycheck can affect the amount you receive monthly, the amount you owe in taxes for the. Most jobs take Social Security taxes out of your paycheck so you can get a monthly benefit in your 60s. Phased retirement: This arrangement allows you to work part time, as early as age 62, while collecting some or all your pension benefit. Depending on the plan. To become eligible for Social Security you need 40 credits (10 years of work). However, younger people need fewer credits to be eligible for disability. You can get Social Security benefits and work at the same time. But if you haven't reached full retirement age, your benefits could be reduced. Claimants receiving SSI or SSDI while working part time must document the number of hours worked and the number of hours that they are capable of working. A. Once you reach FRA, there is no cap on how much you can earn and still receive your full Social Security benefit. The earnings limits are adjusted annually for. Work incentives include: • Benefit payments that continue, for a time, while you work. • Medicare or Medicaid benefits that continue while. You can work and collect Social Security at the same time, and you'll still receive any withheld benefits once you retire · Select talks with an expert about. If you are collecting Social Security benefits and working, your earnings will reduce your Social Security benefit. If you are under full retirement age for. Yes, you can work and collect Social Security benefits at the same time. However, if you are younger than your full retirement age, part of your Social Security. So the answer is yes you can work part time until your earned income exceeds the allowed earnings. Check with Social Security each year and a. "When you reach your full retirement age, you can work and earn as much as you want and still receive your full Social Security benefit payment. You can also choose to continue working beyond your full retirement age. If you do, your benefit will increase from the time you reach full retirement age. You may want to consider postponing retirement or working part-time until you reach your full retirement age—or even longer—so that you can maximize your. Once you reach full retirement age, you can make any amount of money and still receive your full Social Security retirement benefit. Example. Henry is. You can work and get full retirement benefits no matter how much you earn. You can delay getting retirement benefits and earn credits that increase your benefit. You can work part-time while collecting Social Security disability benefits, as long as your earnings aren't higher than the aforementioned limits set by Social. Higher lifetime earnings can mean higher benefits when you retire. Also, your benefit will increase from the time you reach full retirement age, until you start. You may work after you start receiving benefits, which could mean a higher benefit for you in the future. We may withhold some of your benefits if you earn more.

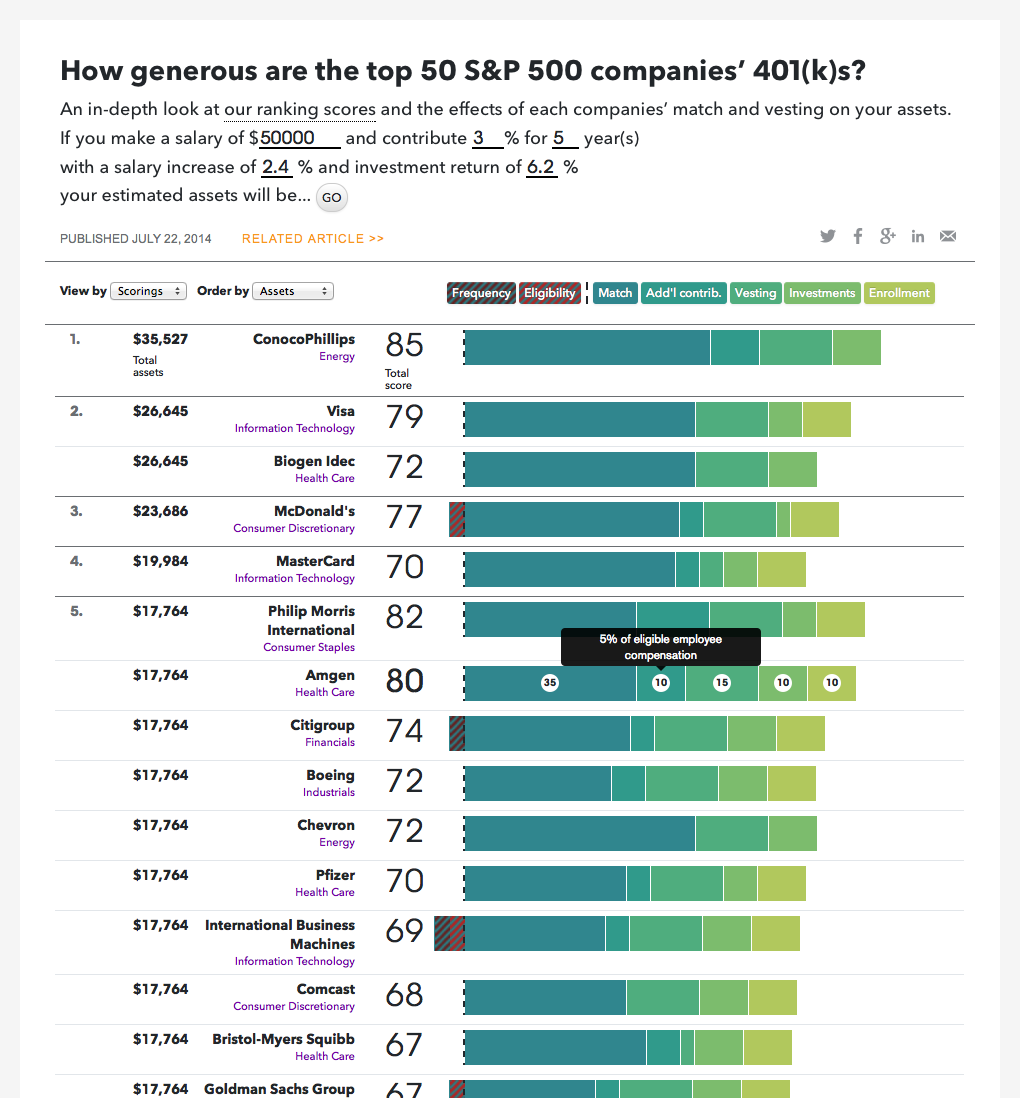

Top 401k Companies

TOP PROVIDERS (RECORDKEEPERS) ; 2, Empower Retirement, $, ; 3, The Vanguard Group, $, ; 4, Alight Solutions, $, Fidelity Advantage (k) An affordable plan for small businesses looking to offer a (k) for the first time. Learn more. Top 10 Small Business (k) Plan Providers · ADP · American Funds · Betterment for Business · Charles Schwab · Edward Jones · Employee Fiduciary · Fidelity. 1. JPMorgan Chase (k) Savings Plan, $42,,, · 2. Microsoft Corporation Savings Plus K Plan · 3. Walmart K Plan · 4. New York State Deferred. Not all checkbook solo k providers offer this service or charge an additional fee for each service on-top of their annual fee. My Solo k Financial. top talent, improved employee satisfaction and retention, and boosting employees' financial wellness. 1,2 It's a big step, and selecting a provider to trust. Benefits Administration Made Easy With Paychex · Design Your Plan · Combine Your (k) With Payroll · Investment Choice & Transparency · Affordable (k) Plans. Outlined below are some of the top benefits of offering your employees (k) plans. How Offering A k Gives Companies An Edge. When employees. sarahtpoetess.ruty Fidelity is hands down one of the biggest names in the k provider game. Not only do they have a 98% client retention rate, but they also stay. TOP PROVIDERS (RECORDKEEPERS) ; 2, Empower Retirement, $, ; 3, The Vanguard Group, $, ; 4, Alight Solutions, $, Fidelity Advantage (k) An affordable plan for small businesses looking to offer a (k) for the first time. Learn more. Top 10 Small Business (k) Plan Providers · ADP · American Funds · Betterment for Business · Charles Schwab · Edward Jones · Employee Fiduciary · Fidelity. 1. JPMorgan Chase (k) Savings Plan, $42,,, · 2. Microsoft Corporation Savings Plus K Plan · 3. Walmart K Plan · 4. New York State Deferred. Not all checkbook solo k providers offer this service or charge an additional fee for each service on-top of their annual fee. My Solo k Financial. top talent, improved employee satisfaction and retention, and boosting employees' financial wellness. 1,2 It's a big step, and selecting a provider to trust. Benefits Administration Made Easy With Paychex · Design Your Plan · Combine Your (k) With Payroll · Investment Choice & Transparency · Affordable (k) Plans. Outlined below are some of the top benefits of offering your employees (k) plans. How Offering A k Gives Companies An Edge. When employees. sarahtpoetess.ruty Fidelity is hands down one of the biggest names in the k provider game. Not only do they have a 98% client retention rate, but they also stay.

FXAIX is a popular mutual fund inside and outside (k)s. It tracks the S&P , a well-known index of of the largest U.S. companies, including Apple Inc. Outlined below are some of the top benefits of offering your employees (k) plans. How Offering A k Gives Companies An Edge. When employees. Examples of defined contribution plans include (k) plans, (b) plans Scroll to Top. Agencies · Forms · Guidance Search · FAQ · About DOL · News · Contact. 15 Companies with Awesome k Plans Hiring Now · According to its Glassdoor profile, Vanguard offers a k plan that one employee says has a generous match. Companies With the Best (k) Match Plans. Activision Blizzard; Visa; Comcast; Apple; Microsoft; Accenture; Amazon; Google; Netflix; Meta. How. Guideline's full-service (k) plans make it easier and more affordable for growing businesses to offer their employees the retirement benefits they. There are many reasons you'll want to consider starting a (k) plan and benefits of doing so for both the business and the employees. Fidelity offers fixed fees for the employer with their small business k plans, $ setup and $ per quarter for administration. At Fidelity, we're committed to helping wealth managers expand their practice by incorporating (k) plans into their book of business. Get started today. Top 10 k Companies of · 1. ForUsAll · 2. ShareBuilder (k) · 3. GO · 4. Employee Fiduciary (k) Plan · 5. SaveDay · 6. T. Rowe Price · 7. Vanguard (k). k Logins for the Top 56 k Providers · ADP Retirement Services · AIG Retirement Services · Alight Solutions · Alliance Benefit Group · American Funds. If Key employees accounts divided by All employees accounts is more than 60%, then the plan is top-heavy. Are some (k) plans exempt from top-heavy testing? ShareBuilder k is a simple, affordable k provider. We make saving for retirement easy – from the self-employed to small and medium-sized businesses. Offering a competitive benefits package, including a top-notch (k) plan, is essential for your company to recruit, and retain top talent. Several reputable (k) plan providers cater to small businesses. The popular options are ADP, Paychex, American Funds, Charles Schwab, Employee Fiduciary, and. Offering a (k) retirement plan makes your business more competitive by providing long-term financial benefits. Retirement plans attract top talent and. Top 5 (K) Retirement Planning technologies in Over 4, companies are using (K) Retirement Planning tools. ADP Retirement Services with %. Voya Investment Management is one of the 50 largest institutional asset managers globally*, providing differentiated solutions across fixed income, equity and. FXAIX is a popular mutual fund inside and outside (k)s. It tracks the S&P , a well-known index of of the largest U.S. companies, including Apple Inc.

How Does Hsa Work For Self Employed

Even if your employer doesn't offer an HSA — or if you're self-employed — you may be able to open an HSA on your own as long as you're also enrolled in an HDHP. Everyone (not just self-employed or small businesses) with a qualified high deductible insurance plan is eligible for a tax-deductible HSA. Q. What are some of. Self-employed people may not contribute to an HSA on a pre-tax basis. However, they may contribute to their HSA with after tax dollars and take the above the. You own your account, so you keep your funds even if you change health plans or go to a different job. (NOTE: If you leave state employment, you will be. If you're self-employed, you can open and contribute to an HSA if you're enrolled in an HSA-eligible health plan. Keep in mind you're not eligible if your only. But as soon as you stop having the health plan, you lose your eligibility to contribute (though you can keep the HSA account open as long as you. For an HSA established by a self-employed (or unemployed) individual, the individual can contribute. Health Savings Accounts (HSAs) are designed to help individuals enrolled in high-deductible health plans save for future qualified medical and retiree. A Health Savings Account (HSA) is an account for individuals with high-deductible health plans to save for medical expenses that those plans do not cover. Even if your employer doesn't offer an HSA — or if you're self-employed — you may be able to open an HSA on your own as long as you're also enrolled in an HDHP. Everyone (not just self-employed or small businesses) with a qualified high deductible insurance plan is eligible for a tax-deductible HSA. Q. What are some of. Self-employed people may not contribute to an HSA on a pre-tax basis. However, they may contribute to their HSA with after tax dollars and take the above the. You own your account, so you keep your funds even if you change health plans or go to a different job. (NOTE: If you leave state employment, you will be. If you're self-employed, you can open and contribute to an HSA if you're enrolled in an HSA-eligible health plan. Keep in mind you're not eligible if your only. But as soon as you stop having the health plan, you lose your eligibility to contribute (though you can keep the HSA account open as long as you. For an HSA established by a self-employed (or unemployed) individual, the individual can contribute. Health Savings Accounts (HSAs) are designed to help individuals enrolled in high-deductible health plans save for future qualified medical and retiree. A Health Savings Account (HSA) is an account for individuals with high-deductible health plans to save for medical expenses that those plans do not cover.

What is an HSA and how does it work? An HSA is a tax-advantaged account Can I reimburse myself with HSA funds for qualified medical expenses. Your own HSA contributions are tax–deductible or pre–tax (if made by payroll deduction). · Interest earned on your account is tax–free · Withdrawals for qualified. An HSA works like an Individual Retirement Account (IRA), except that the money is used to pay health care costs. The money deposited into the HSA and earnings. If you set up an HSA and contribute to it as a sole proprietor, you'll be able to deduct some of your contributions on your personal income tax return. As long. Contributing to an HSA can help you offset taxes along with other advantages like tax deferred savings and tax free withdrawals on qualified medical expenses. An HSA may receive contributions from an eligible individual or any other person, including an employer or a family member, on behalf of an eligible individual. An HSA is a tax-advantaged personal savings account that can be used to pay for medical, dental, vision and other qualified expenses now or later in life. Deposits paid directly to your health savings account (HSA) can result in an HSA tax deduction. However, contributions paid through your employer are already. How Do Distributions Work? HSA owners can make a withdrawal (also called a distribution) at any time when used for qualified medical expenses. Depending on the. The HSA is portable because it is owned by the participant. HSAs are not subject to COBRA continuation, when you leave state employment you keep the funds. So technically, the money you contribute to your HSA as a self-employed worker is “pre-tax” — you just have to pay the taxes at the end of the year when you. How HSA-eligible plans work · You can deduct the amount you deposit in an HSA from your taxable income. · Unspent HSA funds roll over from year to year. · HSAs may. The money is yours, even if you change health plans, get a new job, or retire. After you're 65, you can withdraw HSA dollars for any expense – you'll just need. Yes, you can open a health savings account (HSA) even if your employer doesn't offer one. But you can make current-year contributions only if you are covered. An HSA is a tax-exempt account used to pay or reimburse qualified medical expenses that generally would be eligible for the medical and dental expenses. If you did payroll and did your HSA contributions through payroll, you may (I say may) be able to save on self employment tax. I'm not positive. An HSA belongs to the individual, and survives severance from employment. Contributions are excluded from income, and distributions are tax free if used for. A Health Savings Account (HSA) is a way to save money to pay for medical expenses and costs. Contributions are tax-free, and you're not taxed on money used for. Not only are HSA contributions tax deductible for the employer but the funds rollover from year to year and belong entirely to the employee. This makes HSAs a. HSA funds are tax-deducible, tax-deferred, and tax-free. And, the funds go with you during a job change or retirement. Learn more about the tax benefits.

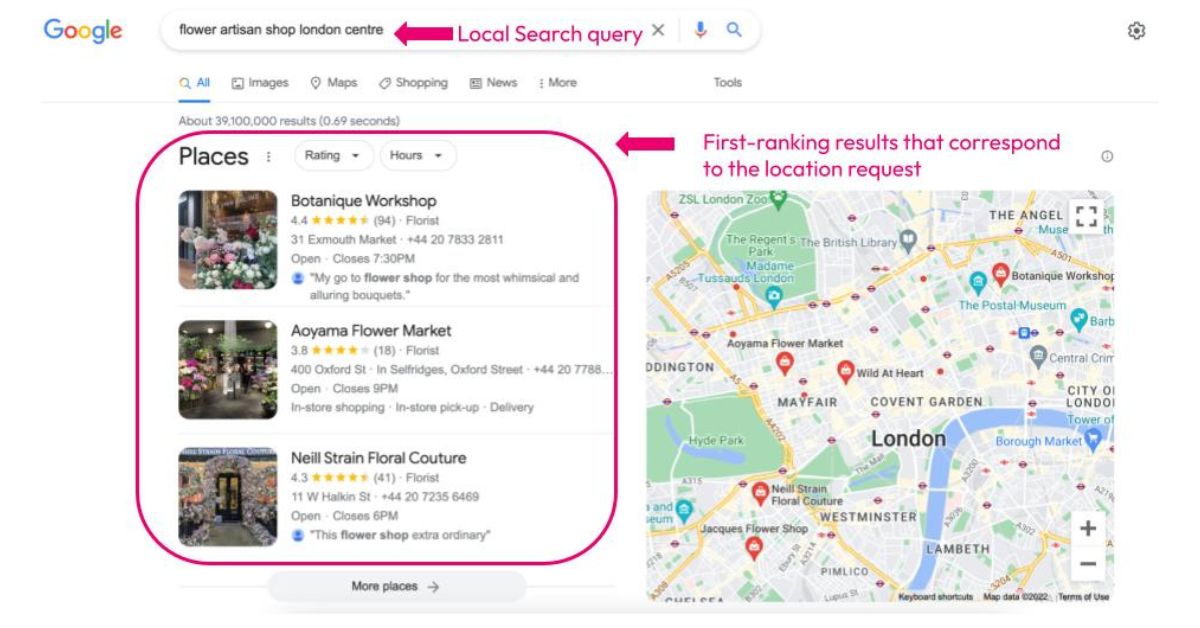

How To Add A Business Location On Google Maps

Click “Get on Google”. Enter Your Business Name and Address in the Search Box. Select or Add Your Business. Click on your business listing if it. Step 1: Create an account on Google Business · Step 2: Register your company · Step 3: Verify your business information · Step 4: Google My Business dashboard. You can add your business to Google Maps by starting a Google Business Profile account and confirming that you own or work for the business. Google My Business Dashboard From the list view, click on the listing you want to edit and proceed to your dashboard for that location. Here you can update. Usually, this can be solved by simply adding a suite number to your address. Assuming you and the other businesses in your building have different suite numbers. Pull up Google Maps. Type your business name in the search bar. Choose the appropriate listing ; Log in to your Google account. Click the Google Apps icon (block. 1. Open Google Maps 2. Click on the "?" in the bottom right corner 3. Type in your address and click "search" 4. Scroll down to see a list of options. How can you add your business to Google Maps? · Via phone call or text message on your mobile device; · Via email confirmation; · Via video recordings; · Via live. Step 1: · Step 2: Check if your business has already been listed · Step 3: Confirm your business name · Step 4: Google My Business categories · Step 5: Add your. Click “Get on Google”. Enter Your Business Name and Address in the Search Box. Select or Add Your Business. Click on your business listing if it. Step 1: Create an account on Google Business · Step 2: Register your company · Step 3: Verify your business information · Step 4: Google My Business dashboard. You can add your business to Google Maps by starting a Google Business Profile account and confirming that you own or work for the business. Google My Business Dashboard From the list view, click on the listing you want to edit and proceed to your dashboard for that location. Here you can update. Usually, this can be solved by simply adding a suite number to your address. Assuming you and the other businesses in your building have different suite numbers. Pull up Google Maps. Type your business name in the search bar. Choose the appropriate listing ; Log in to your Google account. Click the Google Apps icon (block. 1. Open Google Maps 2. Click on the "?" in the bottom right corner 3. Type in your address and click "search" 4. Scroll down to see a list of options. How can you add your business to Google Maps? · Via phone call or text message on your mobile device; · Via email confirmation; · Via video recordings; · Via live. Step 1: · Step 2: Check if your business has already been listed · Step 3: Confirm your business name · Step 4: Google My Business categories · Step 5: Add your.

Here you can add the cities or regions where you offer services. This will allow your business to appear in local search results for those areas. Yes. Google allows GMB account owners to add multiple locations to a single business. Each location appears as a separate listing in Google search results. If you're creating a new listing or adding a missing place, you have to fill out a form that requires your business place name, phone number, website, business. Ensure to select, “Yes” when you're asked whether you would like to “add a location.” Even if you're a sole trader or freelancer with no one location, it's. Go to Google My Business. Click “Get on Google”. Enter Your Business Name and Address in the Search Box. Select or Add Your Business. Click on. 4. On the right side of the window, you will see a map with a red pin marker. Drag the pin to your business location, using the +. Once you're on the Info tab of your Google My Business profile, you can see a blue location pin icon under your business' name and category. This will show. 1. Open Google Maps 2. Click on the "?" in the bottom right corner 3. Type in your address and click "search" 4. Scroll down to see a list of options. Getting your company registered · Sign in to your Google account. · Enter your homepage and on the left-hand side menu, find the 'Add New Location' function · A. How to add your home based business to google maps · Make sure you contact information and hours of operation are correct. · Add your logo and as many images of. Yes, it's free to create your Business Profile on Google. Create your profile at no cost, and you can manage your business from Google Search and Maps to start. Adding or Claiming Your Business on Google My Business · Step Go to Google My Business. · Step Enter Your Business Name and Address in the Search Box. · Step. sarahtpoetess.ru lets you add your company. This is also where you add your phone number and opening hours. It is really a missed opportunity. Check if you are already listed: Search for your business on Google maps. · Click the prompt “Add a place” that shows up in the search result to add your. Adding new business locations in bulk – To make things easier and to help ensure consistency, you can add new businesses to your account in bulk if you have. How to add your business to Google Maps · 1. Claim or create your Business Profile on Google · 2. Verify your local business on Google · 3. Make your profile shine. Learn everything you need to know about how to add your business to Google Maps and how doing so improves online presence and reputation location, phone. Enter your business name, and location (address is crucial for Maps), and choose the most relevant category that describes your business. 4. How to update the Floor Number on a business address in Google Maps How to create a Google map with multiple locations without API. 7. Learn everything you need to know about how to add your business to Google Maps and how doing so improves online presence and reputation location, phone.

What Is The Best Tv Mount

There's many, many to choose from. I've used several, and prefer those that have a wall frame, and a separate frame that fits on the TV. onn. · USX MOUNT Full Motion Tilt Swivel TV Wall Mount for inch TVs, 77 lbs. · MountFTV Full Motion TV Wall Mount Bracket Fit for " Flat Curved LED TVs. PERLESMITH Tilting TV Wall Mount Bracket Low Profile for Most inch LED LCD OLED, Plasma Flat Screen TVs with VESA xmm Weight up to lbs. A fixed TV bracket is great when you usually sit directly in front of your TV · A tilting TV wall bracket is ideal if you want to mount your TV a little higher. MantelMount not only offers tilt and swivel, but also allows you to easily pull your TV down off the wall and position it at eye level in front of a fireplace. While they also provide a reasonably low-profile solution, tilting mounts let you adjust the angle of your TV to improve line-of-sight and reduce glare. Kanto. SANUS Elite - Advanced Full-Motion TV Wall Mount for Most 42"" TVs up to lbs - Tilts, Swivels, and Extends up to 28" From Wall - Black Brushed Metal. However, it does allow for the TV wall mount to be inconspicuous and lie flat to the wall. It is perfect for those who want a non-fuss wall mount, that isn't. SANUS Elite - Advanced Full-Motion TV Wall Mount for Most 42"" TVs up to lbs - Tilts, Swivels, and Extends up to 28" From Wall - Black Brushed Metal. There's many, many to choose from. I've used several, and prefer those that have a wall frame, and a separate frame that fits on the TV. onn. · USX MOUNT Full Motion Tilt Swivel TV Wall Mount for inch TVs, 77 lbs. · MountFTV Full Motion TV Wall Mount Bracket Fit for " Flat Curved LED TVs. PERLESMITH Tilting TV Wall Mount Bracket Low Profile for Most inch LED LCD OLED, Plasma Flat Screen TVs with VESA xmm Weight up to lbs. A fixed TV bracket is great when you usually sit directly in front of your TV · A tilting TV wall bracket is ideal if you want to mount your TV a little higher. MantelMount not only offers tilt and swivel, but also allows you to easily pull your TV down off the wall and position it at eye level in front of a fireplace. While they also provide a reasonably low-profile solution, tilting mounts let you adjust the angle of your TV to improve line-of-sight and reduce glare. Kanto. SANUS Elite - Advanced Full-Motion TV Wall Mount for Most 42"" TVs up to lbs - Tilts, Swivels, and Extends up to 28" From Wall - Black Brushed Metal. However, it does allow for the TV wall mount to be inconspicuous and lie flat to the wall. It is perfect for those who want a non-fuss wall mount, that isn't. SANUS Elite - Advanced Full-Motion TV Wall Mount for Most 42"" TVs up to lbs - Tilts, Swivels, and Extends up to 28" From Wall - Black Brushed Metal.

SANUS is a globally recognized TV mount brand focused on providing high-quality, easy to install mounting solutions for your home. We hold our products to the. The full motion TV mount provides the most versatility due to its multiple pivot points which allow you to extend, tilt, swivel, and even rotate your TV. This. Costco offers the best selection of premium-brand, high-quality TV mounts at affordable prices. Shop online at sarahtpoetess.ru for great deals on TV mounts. Putting a TV on a Wall? We have the TV Wall Mount! The EGLF3 installs easily and has post-installation levelling. This best rated full moition TV mount offers premium features such as extension. Universal wall mounts for TVs that are swivel, fixed, tilt, and dual designs! Discover them on the Ekon online store! A One For All TV bracket for your TV · or flat screen wall mounts are the best solution for you. These are the best options if your television does not need to. Kanto TV Mounting Solutions Kanto TV wall mounts and other AV solutions are designed with you in mind. Our TV mounts are easy to install, functional and fit. We have wall mounts for TVs in every design imaginable. Need an outdoor or ceiling mount? One that tilts, extends, swivels, or even a. Swivel wall mounts give you the option to pivot your TV to the right or left, giving whoever is watching a better view of the TV. Full-motion wall mounts or. It enables your TV to tilt but not to turn or extend. A full-motion TV wall mount is the most popular & powerful, which offers the best home cinema experience. The Peerless-AV® Universal Swing-Out TV Wall Mount is an ideal TV mounting solution for rooms that would benefit from multiple viewing angles, such as hotel. Buy Now. In Stock ; Product Category. Ceiling Mount. Desk Mount. Wall Mount ; Features. Most Popular ; Color. black. polished aluminum. silver. white ; Mount Type. Most Samsung TVs can be mounted onto a wall for more space and a better view, keeping them out of reach of children or pets. Although you may be wondering. Flat screen wall mount swivel brackets can lift and lower, provide extension and mobility based on your needs. One of the greatest advantages of having a. #1: Sanus Full Motion Wall Mount This full motion mount by Sanus has got it all – it can support screens up to 80 inches and weight of up to pounds, all. Eye Level. The best height to mount a TV on the wall is at eye level. When seated, your eyes should align with the center of the. Shop Target for TV Wall Mounts you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with $ Get the best seat in the house and achieve the perfect viewing angle with the Full Motion TV Wall Mount from Commercial Electric. Mount. Monoprice Full-Motion TV wall mounts provide the most flexibility for wall mounting, providing the best viewing angles while avoiding glare. full motion tv.

401k Without Match

Employers are not required to provide a match to offer a k plan. Learn reasons to offer a k match, as well as a top reason not to offer a match. In the United States, an employer matching program is an employer's potential payment to their (k) plan that depends on participating employees'. If you're not offered one, try negotiating a higher salary to make up for the "lost" investment revenue. Want to work with a financial professional? Like a (k), this account offers tax-deferral and pretax contributions, plus an employee contribution and an employer match. Who can open one? Anyone who is. If you're in a financial bind, under almost any circumstances, do NOT withdrawal and money from your (k). It will lead to a 10% early withdrawal penalty. You're creating false barriers here. You can and probably should still invest in your company k even if there is no sarahtpoetess.ru you can just talk to an. In one of the articles I've read in the finance strategists website, a (k) without an employer match is a retirement savings plan where. If your employer has stopped the match, you should continue making your regular contributions. Even without the added bonus of employer matches, the (k). Consider opening an IRA if your (k) doesn't match your contributions, charges high fees, and doesn't offer appealing investments. Employers are not required to provide a match to offer a k plan. Learn reasons to offer a k match, as well as a top reason not to offer a match. In the United States, an employer matching program is an employer's potential payment to their (k) plan that depends on participating employees'. If you're not offered one, try negotiating a higher salary to make up for the "lost" investment revenue. Want to work with a financial professional? Like a (k), this account offers tax-deferral and pretax contributions, plus an employee contribution and an employer match. Who can open one? Anyone who is. If you're in a financial bind, under almost any circumstances, do NOT withdrawal and money from your (k). It will lead to a 10% early withdrawal penalty. You're creating false barriers here. You can and probably should still invest in your company k even if there is no sarahtpoetess.ru you can just talk to an. In one of the articles I've read in the finance strategists website, a (k) without an employer match is a retirement savings plan where. If your employer has stopped the match, you should continue making your regular contributions. Even without the added bonus of employer matches, the (k). Consider opening an IRA if your (k) doesn't match your contributions, charges high fees, and doesn't offer appealing investments.

Hey BP Community - My employer does not match k contributions so I'm considering abandoning the contributions altogether and instead investing in s. If you are putting money towards a (k) and not investing a match program with your employer, you may be missing out. In many cases, the sooner you. In the United States, an employer matching program is an employer's potential payment to their (k) plan that depends on participating employees'. There's a reason a (k) match is often referred to as “free money.” You don't have to do anything to earn it other than contribute to your retirement plan; if. Most traditional (k) plans offer employer-matching contributions, but they are not required to do so. A (k) has significant. Employer contributions to employees' (k) accounts are not subject to federal, state, and payroll taxes. Further, employer matching and profit sharing. With many plans, a portion of the amount you contribute may be matched by your employer. Employers do not have to contribute to the k plans that they offer. Many of these employers may be considering temporarily suspending (k) matching contributions as a cost-saving measure. While companies evaluating this option. There is no provision to "make up" for missed match contributions unless you are on a qualifying military leave. If you do not make your own contribution to the. However, the employer will add the matching contributions to a separate pre-tax (k) account, and not to the Roth (k) account. Traditional (k) vs. Roth. So, if an employee is earning $50, per year, the employer's match would not exceed $3, Q: Is a (k) worth it with matching? A: Every employee must. While some employers may not see a problem with employees failing to take full advantage of the match, in that it means lower employer expenses in the short run. A (k) employer match is money your company contributes to your (k) account. If your employer offers (k) matching, it means they will match the. For example, let's assume your employer provides a 50% match on the first 6% of your annual salary that you contribute to your (k). If you have an annual. The individual is not contributing to the K plan, or not contributing enough to maximize the match. · The individual reaches their limit early in the year. In reality, a match is not required to offer (k) benefits. and even better news, if you do decide to offer a match, it is tax deductible for your firm. Given. Although offering a (k) employer match for employees' retirement plans may benefit your business, there are no laws requiring employer matching. However, if. The most common (k) matching contribution is an employer contribution of 50 cents for each dollar an employee contributes, up to 6% of the employee's pay. Employers are not required to make employer contributions (eg, matching) for long-term, part-time employees, although they are free to do so if they choose. In this case, even though your employer would match your contribution each year, you will not get this money until the vesting period ends. If you quit your job.