sarahtpoetess.ru

News

How Frequently Can You Apply For A Credit Card

Capital One limits cardholders to one new card every six months, so if you're thinking about getting a couple of cards from the issuer, apply for one, then set. can review your credit card account with you and guide you through the next steps. Expand Who do I contact if I didn't apply for this credit card? Please. The 5/24 rule: For some issuers, applicants can't open more than five new credit card accounts in a month period. Even though there is no significant amount of time for which you should wait, experts usually say that you should wait at least 6 months before applying for a. Credit card applications for well-qualified applicants are processed relatively fast. Physical cards, however, can take about 2 weeks to arrive in the mail. You. For most issuers, the earliest you can get a credit card on your own is at 18 years of age. However, if you are willing to become an authorized user. How Often Should You Apply for a Credit Card? While it's not recommended, in theory, you can apply for new credit cards as often as you like. Since the. It depends more on how you use your credit cards than how often. I have three credit cards that I use regularly, a Chase card, a Home Depo. It's best to apply for a credit card about once a year, assuming you need or want a card in the first place. And you shouldn't apply for more than one card. Capital One limits cardholders to one new card every six months, so if you're thinking about getting a couple of cards from the issuer, apply for one, then set. can review your credit card account with you and guide you through the next steps. Expand Who do I contact if I didn't apply for this credit card? Please. The 5/24 rule: For some issuers, applicants can't open more than five new credit card accounts in a month period. Even though there is no significant amount of time for which you should wait, experts usually say that you should wait at least 6 months before applying for a. Credit card applications for well-qualified applicants are processed relatively fast. Physical cards, however, can take about 2 weeks to arrive in the mail. You. For most issuers, the earliest you can get a credit card on your own is at 18 years of age. However, if you are willing to become an authorized user. How Often Should You Apply for a Credit Card? While it's not recommended, in theory, you can apply for new credit cards as often as you like. Since the. It depends more on how you use your credit cards than how often. I have three credit cards that I use regularly, a Chase card, a Home Depo. It's best to apply for a credit card about once a year, assuming you need or want a card in the first place. And you shouldn't apply for more than one card.

If you do not maintain the right credit utilisation rate, your credit score may be reduced. When you apply for a loan in the future, the number of credit cards. If you do not maintain the right credit utilisation rate, your credit score may be reduced. When you apply for a loan in the future, the number of credit cards. Can I pay for multiple procedures at one time with my CareCredit health and wellness credit card? Does my CareCredit credit card expire? How do I use CareCredit. How often you can request a credit limit increase depends on the card issuer, but unless you've received an increase within the last six months, many will let. Generally, it's a good idea to wait about six months between credit card applications. Since applying for a new credit card will result in a slight reduction to. You can revoke your opt-in at any time. Caps on high-fee cards. If your credit card company requires you to pay fees (such as, an annual fee or application. How Often Can I Apply for a Credit Card Without Hurting My Credit? Per Experian, one of the three major credit bureaus, it's wise to wait at least six months. It's tempting to sign up for a card with a high annual fee because they often come with a lot of cool perks, like statement credits, access to upgrades and big. Having at least one credit card is a good thing because it can help you build credit. But how many credit cards should you have? There's no one-size-fits-all. You typically have the option of applying over the phone, in person, or online. Applying online is the quickest method, since a lending decision is often made. With any credit card provider you can re-apply but you should wait at least 6 months. Applying for credit constantly will reflect bad on your. How often should you apply for a credit card? It's true that keeping multiple credit cards can sometimes benefit your credit scores. But that doesn't mean you. When managed properly, having multiple credit cards can allow savvy cardholders to maximize rewards and other benefits, such as interest-free financing and. If you've applied for credit cards before Applying for too many cards or regularly switching cards can affect your credit rating. Each time you make an. However, it is generally recommended to wait at least six months to a year before applying for another credit card. Here are a few reasons why. Can I Apply for More Than One Credit Card? You may apply for as many credit cards as you like. But when you apply for credit multiple times over a long period. How often can I get a free report? ·. That's in addition to the one free Equifax report (plus your Experian and TransUnion reports) that you can get annually at. If you're planning to apply for a mortgage or car loan, it's best to avoid applying for credit cards in the months leading up to your loan application. The. What information does Capital One require when I apply for a credit card? If you apply by phone or online, you will often get a response in 60 seconds. When applying for a loan or credit product, your credit is pulled and the credit score used in that application is retrieved the day you apply. Also, if you've.

Xps 13 Amazon

Dell XPS 13 Touchscreen Laptop inch FHD+ Thin and Light. Intel Core iG7, 16GB LPDDR4x RAM, GB SSD, Intel Iris Xe Graphics, Windows 11 Pro. sarahtpoetess.ru: Dell XPS 13 " Notebook - X - Core IU - 8GB RAM - GB SSD - Platinum Silver, Carbon Black: Electronics. Dell XPS 13 Laptop " 4K UHD Touch Display, 8th Generation Intel Core iU Processor, 8GB RAM, GB SSD, Webcam, Fingerprint Reader, HDMI. sarahtpoetess.ru: Dell XPS 13 Touchscreen inch FHD Thin and Light Laptop - Intel Core iG7, 16GB LPDDR4x RAM, GB SSD, Intel Iris Xe Graphics. sarahtpoetess.ru: Dell XPS 13 inch Ultra HD+ ( x ) Touchscreen Laptop - 11th Gen Intel Core iG7 up to GHz CPU, 16GB LPDDR4x RAM. sarahtpoetess.ru: Dell XPS 13 - " UHD InfinityEdge, 8th Gen Intel Core i7, 16GB RAM, 1TB SSD - Silver - Dell XPS 13 (Latest ) " Laptop Intel 12th Gen iU (Core) GB PCIe SSD 8GB RAM FHD+ (x) Nit Non Touch Windows 11 Pro (Renewed). sarahtpoetess.ru: Dell XPS 13 (Latest Model) inch Laptop Intel Core iG7 11th Gen GB SSD 8GB RAM FHD P Windows 10 Home (Renewed). Dell XPS 13 Touchscreen Laptop inch UHD+ Thin and Light, Intel Core iG7, 16GB LPDDR4x RAM, G SSD, Intel Iris Xe Graphics, Windows 11 Home. Dell XPS 13 Touchscreen Laptop inch FHD+ Thin and Light. Intel Core iG7, 16GB LPDDR4x RAM, GB SSD, Intel Iris Xe Graphics, Windows 11 Pro. sarahtpoetess.ru: Dell XPS 13 " Notebook - X - Core IU - 8GB RAM - GB SSD - Platinum Silver, Carbon Black: Electronics. Dell XPS 13 Laptop " 4K UHD Touch Display, 8th Generation Intel Core iU Processor, 8GB RAM, GB SSD, Webcam, Fingerprint Reader, HDMI. sarahtpoetess.ru: Dell XPS 13 Touchscreen inch FHD Thin and Light Laptop - Intel Core iG7, 16GB LPDDR4x RAM, GB SSD, Intel Iris Xe Graphics. sarahtpoetess.ru: Dell XPS 13 inch Ultra HD+ ( x ) Touchscreen Laptop - 11th Gen Intel Core iG7 up to GHz CPU, 16GB LPDDR4x RAM. sarahtpoetess.ru: Dell XPS 13 - " UHD InfinityEdge, 8th Gen Intel Core i7, 16GB RAM, 1TB SSD - Silver - Dell XPS 13 (Latest ) " Laptop Intel 12th Gen iU (Core) GB PCIe SSD 8GB RAM FHD+ (x) Nit Non Touch Windows 11 Pro (Renewed). sarahtpoetess.ru: Dell XPS 13 (Latest Model) inch Laptop Intel Core iG7 11th Gen GB SSD 8GB RAM FHD P Windows 10 Home (Renewed). Dell XPS 13 Touchscreen Laptop inch UHD+ Thin and Light, Intel Core iG7, 16GB LPDDR4x RAM, G SSD, Intel Iris Xe Graphics, Windows 11 Home.

Dell XPS 13 Plus Laptop, Intel Core iP, 16GB, 1TB SSD, Win 11 + MSO'21, " (Cms) UHD+ AR nits Touch, 15 Month McAfee, Backlit KB. sarahtpoetess.ru: Dell XPS 13 Plus Business Laptop, " 4K UHD OLED Touchscreen, Intel Core iP, Zero-Lattice Backlit Keyboard, Fingerprint Reader. The Dell XPS 13 laptop. Dell's Latest XPS 13 Is Thinnest Yet, With New Intel sarahtpoetess.ru: Bose SoundLink Revolve+ (Series II) Bluetooth Speaker. sarahtpoetess.ru: DELL XPS 13 Plus Laptop, " 4K UHD OLED Touchscreen, Intel Core iP, Zero-Lattice Backlit Keyboard, Fingerprint Reader, Killer Wi-Fi 6E. Dell XPS 13 Laptop - inch OLED K (x) Touchscreen Display, Intel Core iG7, 16GB LPDDR4x RAM, G SSD, Intel Iris Xe Graphics. r/linux · Update 2: Dell XPS 13 () laptop, developer edition – Sputnik Gen 4 Amazon Prime · r/buildapcsales - [Keyboard] Keychron. sarahtpoetess.ru: Dell XPS 13 Laptop () | " FHD+ | Core i5 - GB SSD - 8GB RAM | 10 Cores @ GHz - 12th Gen CPU Win 11 Home (Renewed). This PC has been certified by Amazon. With Alexa built-in, you can. Ask to set reminders, check your calendar, control smart home devices, and more with this PC. Amazon Renewed is your trusted destination for products that are inspected, tested, and refurbished as necessary to be fully functional. Quality that you can. Targus USB4 Triple Video Docking Station with W Power. $ at Amazon. See It Best Laptop Deal of the Day: Save $ on Dell's Flagship. Dell XPS 13 2-in-1, inch FHD+ Touch Laptop - Intel Core iG7, 8GB LPDDR4 RAM, GB SSD HD, Intel iris, Windows 10 Home · XPS inch 2 in 1 Laptop. sarahtpoetess.ru: Dell XPS 13 (Latest ) / Laptop Intel 12th Gen iU (Core) GB PCIe SSD 16GB RAM FHD+ (x) Nit Non Touch Windows. sarahtpoetess.ru: Dell XPS 13 Touchscreen Laptop - inch UHD+ Display, Thin and Light, Intel Core iG7, 16GB LPDDR4x RAM, GB SSD, Intel Iris Xe. sarahtpoetess.ru: XPS 13 2-in-1 inch FHD+ Touch Laptop, Intel 10th Gen iG7, 16GB RAM, GB SSD, Intel Iris Plus, Active Stylus Pen, Arctic White. sarahtpoetess.ru: DELL XPS 13 " FHD+ (Intel Core iU, 16GB LPDDR5 RAM, GB SSD) Thin & Light Business Laptop, Hr Battery Life, Thunderbolt 4. sarahtpoetess.ru: Dell XPS 13 Laptop - inch FHD (x) Display, Intel Core iG7, 16GB LPDDR4x RAM, GB SSD, Intel Iris Xe Graphics. Dell XPS 13 Plus Developer Edition. $1, $1, at Amazon. Dell's XPS 13 at Amazon. OK, it's corny, but there's something about the Lenovo X1 Carbon. sarahtpoetess.ru: New XPS 13 Plus Laptop " 4K UHD+ InfinityEdge Touch Nit Display 12th Gen iP 4TB Gen 4 SSD 32GB Ram Stylus Pen Light Win Dell XPS 13 (Latest ) " Laptop Intel 12th Gen iU (Core) GB PCIe SSD 8GB RAM FHD+ (x) Nit Non Touch Windows 11 Pro (Renewed). NEW XPS 13 LAPTOP. Effortless Mobility. Powerful AI. XPS 13 with Intel® Core™ Ultra processors Series 2 enables new AI experiences. Pre-Order Now. 1/3. Pause.

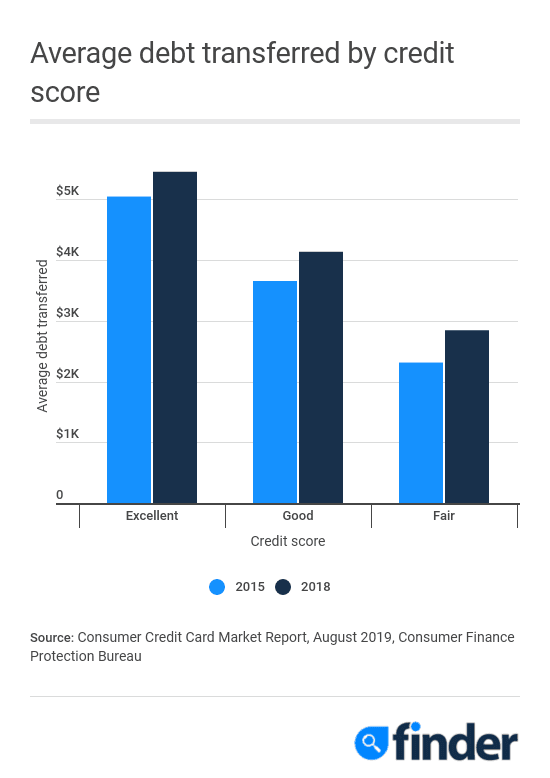

Average Balance Transfer Amount

The average credit card balance transfer fee is % of the amount you transfer, and you need to take this cost into account when deciding whether a. With an APR as low as % and no annual or balance transfer fees, our low rate credit card is great for large purchases you want to pay off over time. Enjoy rates as low as % when you transfer your balances to one of our cards. No balance transfer fee. The national average balance transfer fee is %. A 15K balance with 70K or higher of available credit isn't crazy unless your income is comparatively low or you have a gigantic mortgage or. amount you're transferring credit limit, will mean you'll have to pay interest. Any fees you have to pay – most balance transfers come with a transfer fee. Citi Simplicity® Credit Card · Low intro APRon balance transfers for months · Low intro APRon purchases for months · No annual fee. Will I be charged any fees to make the transfer? Many financial institutions do charge a fee for each new balance transfer. If, for example, you're transferring. A PSECU credit card balance transfer offers no annual fee and no PSECU balance transfer fee The average credit card APR in the United States is %. A balance transfer fee is the amount of money a lender charges a borrower to transfer existing debt from another institution. The average credit card balance transfer fee is % of the amount you transfer, and you need to take this cost into account when deciding whether a. With an APR as low as % and no annual or balance transfer fees, our low rate credit card is great for large purchases you want to pay off over time. Enjoy rates as low as % when you transfer your balances to one of our cards. No balance transfer fee. The national average balance transfer fee is %. A 15K balance with 70K or higher of available credit isn't crazy unless your income is comparatively low or you have a gigantic mortgage or. amount you're transferring credit limit, will mean you'll have to pay interest. Any fees you have to pay – most balance transfers come with a transfer fee. Citi Simplicity® Credit Card · Low intro APRon balance transfers for months · Low intro APRon purchases for months · No annual fee. Will I be charged any fees to make the transfer? Many financial institutions do charge a fee for each new balance transfer. If, for example, you're transferring. A PSECU credit card balance transfer offers no annual fee and no PSECU balance transfer fee The average credit card APR in the United States is %. A balance transfer fee is the amount of money a lender charges a borrower to transfer existing debt from another institution.

How much could I save with no balance transfer fee and a low intro APR? · You could save $1, when you transfer a balance to a Navy Federal Credit Card. The biggest drawback when it comes to balance transfers is the transfer fee. While ESL charges no fees1, most credit cards do. The going rate for a transfer fee. A 3% fee ($10 minimum) applies to each balance transfer. A balance transfer fee is a payment to transfer an existing credit card balance from one card to another. The issuer you're transferring to charges the balance. Next, calculate the transfer fee, which is typically 3% to 5% ($30 to $50 for every $1, transferred). Is there an amount cap on the fee? If not, that can. the Consumer Financial Protection Bureau at sarahtpoetess.ru Fees. Transaction Fees Balance Transfer • 3% of the amount of each balance. Estimated balance transfer limits by bank · Between $5, and $30, on average · Up to $95, on most credit cards. Pay an individual. Balance Transfer Frequently Asked Questions. What happens if the credit limit is lower than the total balance transfer requests and fees? A 15K balance with 70K or higher of available credit isn't crazy unless your income is comparatively low or you have a gigantic mortgage or. Balance transfer credit cards ; Citi Simplicity® Card · reviews · Intro balance transfer APR. 0% for 21 Months · % - %* Variable ; Citi Rewards+® Card. Most balance transfer cards charge a fee for transferring a balance. As mentioned, the fee generally ranges from 3% to 5% of the total balance you're. A balance transfer fee is the amount it costs to transfer the balance from one or multiple cards to another. It ranges between 3%-5% of the balance. This means. Most credit card companies charge a balance transfer fee for paying off a customer's debts. The typical range is between 3% and 5% of the transferred amount. Although some cards will waive all transfer fees, it's typical to be assessed a balance transfer fee of between 3% and 5%. So if you were transferring $3, 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. balance transfer card with a low or 0% introductory APR. Balance Transfer fee: 5% of each transfer amount, $5 minimum. There is a $1 balances in the order of the lowest to highest APR. Any amount over. It can amount to anywhere from 3% to 5% of that balance transfer amount. credit score, too, when you keep a really low utilization rate. And then as. The typical balance transfer fee is 3% of the amount transferred, with a minimum fee of at least $5 or $ Doing a balance transfer can be a great way to get a. credit card to a new card with a low or 0% interest rate. The principal This may be either a fixed amount or a percentage of the balance you're transferring.

Buying From Amazon And Selling On Ebay

Its a violation of eBay policy for a seller to list something they don't possess and when its sold go buy it off of Amazon, Costco, Walmart or wherever, and. Get ready to sell · Choose a selling plan · Create a Seller Central account · Configure your Seller Central account · Use the free Amazon Seller app · Enroll your. Be aware there are times you might receive a package delivered by Amazon that's allowed by eBay. That's when a seller is not buying it on Amazon but they're. Generally, eBay charges a flat 10% selling fee (this varies per category), but this does not include payment processing fees via PayPal. These are typically an. Amazon operates like a traditional retail store, attracting buyers to its site to purchase its listed inventory, while eBay attracts sellers to list their. It's quite possible for your eBay purchase to come from an Amazon Fulfillment Center where the sellers merchandise is stored. This article will guide you through the process of how to buy on eBay to sell on Amazon, covering everything from understanding the basics of both platforms to. Unlike Amazon, eBay's business model is centered around facilitating transactions between buyers and sellers. Unlike Amazon, which primarily sells its own. Yes, third party shipping/drop shipping is legal on eBay, I know that, but it's against eBay policy to NOT state the actual location of what you are selling. Its a violation of eBay policy for a seller to list something they don't possess and when its sold go buy it off of Amazon, Costco, Walmart or wherever, and. Get ready to sell · Choose a selling plan · Create a Seller Central account · Configure your Seller Central account · Use the free Amazon Seller app · Enroll your. Be aware there are times you might receive a package delivered by Amazon that's allowed by eBay. That's when a seller is not buying it on Amazon but they're. Generally, eBay charges a flat 10% selling fee (this varies per category), but this does not include payment processing fees via PayPal. These are typically an. Amazon operates like a traditional retail store, attracting buyers to its site to purchase its listed inventory, while eBay attracts sellers to list their. It's quite possible for your eBay purchase to come from an Amazon Fulfillment Center where the sellers merchandise is stored. This article will guide you through the process of how to buy on eBay to sell on Amazon, covering everything from understanding the basics of both platforms to. Unlike Amazon, eBay's business model is centered around facilitating transactions between buyers and sellers. Unlike Amazon, which primarily sells its own. Yes, third party shipping/drop shipping is legal on eBay, I know that, but it's against eBay policy to NOT state the actual location of what you are selling.

In Amazon to eBay arbitrage, you place your list on eBay and when an order comes, you buy it from Amazon and ship it to the customer. While both platforms offer an avenue to customers, selling on Amazon vs. eBay can involve very different considerations. Are you selling mass-produced products. If you choose to sell on eBay, you must be prepared to ship and fulfill all products on your own. eBay does not offer any special program to ship your products. Wondering if you can sell on eBay and Amazon at the same time At SellerActive, we make it easy for e-commerce businesses to build and manage marketplace. I don't really recommend buying from Ebay, it can cause problems further down the line. Amazon wants you to purchase from authorised and established wholesales. 1. Clothing and accessories Selling things like dresses, bracelets, or sportswear on Amazon or eBay is a great way to reach a wide audience and generate more. All your selected products will sync automatically to eBay, so you can start selling right away. Amazon to eBay Integration. What Makes ExportYourStore the Best. However, IF the seller is selling to you and then buying on Amazon and entering your address as a "gift" address then this is against the policy of both eBay. Selling on Amazon is much easier to manage and scale than selling on the Ebay marketplace. Because Amazon offers order fulfillment via Amazon FBA, managing. In this model, you sell Amazon products to eBay buyers. You only list your items without handling any physical items. The buyer places an order, and you. It can be profitable if amazon has large price drops on certain items. As long as you are shipping the items yourself, it is profitable, and legal. eBay purchases fulfilled by Amazon It is not allowed for the seller to buy it on Amazon after you purchase it from the seller. If they do that the paperwork. Once businesses start selling beyond eBay and Amazon, implementing order management software that integrates with eBay is the most logical next step. You'll. Comparing Amazon and eBay in terms of raw market size is a decisive win for Amazon, who are beaten only by Alibaba and the sheer consumer might of China. Amazon and eBay reserve the right to limit everything about your storefront, what you sell, how you interact with customers, and basically your overall brand. Globally, the fee charged by Amazon tends to be higher than that of eBay. While eBay charges an FFV (Final Value Fee) of 10%, Amazon charges at least 15%. On. star, wrote some sellers sell on both sites so their items are delivered from Amazon. Others use Amazon as a product source (drop shipping agent) which is. In this model, you sell Amazon products to eBay buyers. You only list your items without handling any physical items. The buyer places an order, and you. Primarily, eBay only sells products from third-party sellers, whereas Amazon sells its own products and those from third-party sellers. There is no clear answer when it comes to selling on eBay vs Amazon. Both sites have their pros and cons. Before making a decision make sure you understand.

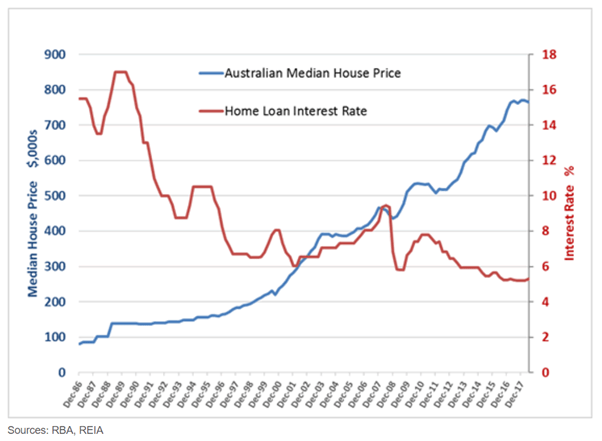

Average Mortgage Rate Australia

The Reserve Bank of Australia (RBA) reviews and sets the cash rate on a monthly basis. average of the rates of large lenders in each category. CommBank, Westpac, NAB, & ANZ Variable Home Loans ; NAB. NAB Tailored Home Loan Variable Rate - Principal and Interest LVR 60% or less. % p.a. ; Commonwealth. Average variable mortgage interest rate. % ; Lowest variable rate available on Finder*. % ; Average fixed mortgage interest rate. % ; Lowest fixed rate. this swap rate, so movements in the swap rate impact the vast majority of wholesale funding costs. The swap rate has been, on average, 20bps wider than the. Our home loan rates · 1 year fixed rate for principal and interest repayments when borrowing % - 98% (including Lenders Mortgage Insurance) of the property. Home loan comparison ; Lowest ANZ home loan rate · % · % ; Lowest NAB home loan rate · % · % ; Lowest CBA home loan rate · % · % ; Lowest Westpac. Lenders' Rates Table ; Owner-occupier, , ; – Principal-and-interest, , ; – Interest-only, , ; Investment, , ; – Principal-and-. Home loan interest rates · Looking for a better home loan rate? · Basic variable rate · % p.a. Interest rate · % p.a.. Comparison rate. Tooltip. Australia Bank Ltd Code of Conduct · Banking Code of Practice · Code of NAB Base Variable Rate Home Loan – Interest Only. Table of interest rates for. The Reserve Bank of Australia (RBA) reviews and sets the cash rate on a monthly basis. average of the rates of large lenders in each category. CommBank, Westpac, NAB, & ANZ Variable Home Loans ; NAB. NAB Tailored Home Loan Variable Rate - Principal and Interest LVR 60% or less. % p.a. ; Commonwealth. Average variable mortgage interest rate. % ; Lowest variable rate available on Finder*. % ; Average fixed mortgage interest rate. % ; Lowest fixed rate. this swap rate, so movements in the swap rate impact the vast majority of wholesale funding costs. The swap rate has been, on average, 20bps wider than the. Our home loan rates · 1 year fixed rate for principal and interest repayments when borrowing % - 98% (including Lenders Mortgage Insurance) of the property. Home loan comparison ; Lowest ANZ home loan rate · % · % ; Lowest NAB home loan rate · % · % ; Lowest CBA home loan rate · % · % ; Lowest Westpac. Lenders' Rates Table ; Owner-occupier, , ; – Principal-and-interest, , ; – Interest-only, , ; Investment, , ; – Principal-and-. Home loan interest rates · Looking for a better home loan rate? · Basic variable rate · % p.a. Interest rate · % p.a.. Comparison rate. Tooltip. Australia Bank Ltd Code of Conduct · Banking Code of Practice · Code of NAB Base Variable Rate Home Loan – Interest Only. Table of interest rates for.

Includes further discount of % p.a.. $3, / monthly. based on a $, loan paying Principal & Interest. Over the years, Australia's interest rates have seen highs of up to almost 18% in January of and a record low of % in November Commonwealth Bank of Australia. Text size: increase | decrease | print page. Online Access. Forgot your password? Home · Products · Training Hub · Interest. Owner occupied variable rates ; ≤ 80%, % pa, % pa ; ≤ 90%, % pa, % pa ; ≤ 95%, % pa, % pa ; Rates are for new loans and are subject to. The average variable rate† in the Mozo database is % p.a., while the lowest home loan rate is Homeloans's Owner Variable Home Loan, at % p.a. (%. Variable home loan rates from %. sarahtpoetess.ru has picked out some of the lowest-rate variable home loans on offer for Australians looking to buy a home. Australia Interest Rate · The Reserve Bank of Australia (RBA) kept its cash rate unchanged at % during its August meeting, retaining borrowing costs for the. 1 year fixed rate. · 2 year fixed rate. · 3 year fixed rate. · 4 year fixed rate. · 5 year fixed rate. With rates rising, now is the time to compare home loans. It's simple and quick, and you can find home loan rates as low as % (comparison rate^ %). rate for new home loans in June (Reserve Bank of Australia). Interest rates are rising, so the average rate may now be higher. Loan type. Owner occupier. Find your best mortgage rate by searching and comparing home loans quickly and easily on RateCity. Rates starting from % (comparison rate* %). + home. Compare home loans from 39 Australian lenders, with lowest home loan rates starting from: Fixed rate. %p.a.*. Comparison rate. %p.a.#. editor-avatar. Compare the best home loan rates in Australia, starting from % pa (comparison rate^ %). Check your eligibility with 26 lenders online, instantly. CommBank, Westpac, NAB, & ANZ Variable Home Loans ; NAB. NAB Tailored Home Loan Variable Rate - Principal and Interest LVR 60% or less. % p.a. ; Commonwealth. % p.a., % p.a.. Standard Variable Rate - Owner Occupier with Advantage Package*. LVR, Annual Rate. Average home loan rates in May · Cash rate: % · Average variable rate home loan (OO, P&I, LVR Average 2-year fixed home loan (OO, P&I. Try our home loans on for size ; Owner Occupier → Principal & Interest · %, % · %, % ; Owner Occupier → Interest Only · %, % · %, %. Current Interest rates in Australia · RBA Cash Rate Target: % · Home loan interest rates as of June · Average rate on a new home loan · What is the RBA. Compare hundreds of home loans from a range of lenders with fixed rates starting at % (comparison rate %) – start your search for a great home loan. Home loan comparison ; Lowest ANZ home loan rate · % · % ; Lowest NAB home loan rate · % · % ; Lowest CBA home loan rate · % · % ; Lowest Westpac.

How To Choose Right Credit Card

This comprehensive guide aims to simplify the process, providing you with the knowledge and tools to choose the credit card that best suits your needs. You can quickly narrow down the choices by carefully assessing your particular needs and what it is you want to accomplish by getting a new credit card. The easiest card to get will depend on your credit score and history. Those with excellent credit will find most cards easy to get. Those who don't will have an. There are different types of credit cards, and the right one for you will depend on what you want to achieve. Do you have a low or limited credit history, and. Determine whether a low interest card is what you're looking for or a card with more substantial rewards. If you're unsure how to decide - or trying to learn. The idea is to figure out how credit cards can work best for you and your financial situation to help you achieve your goals. Checklist of what to look out for when choosing a credit card · Annual Percentage Rate (APR). This is the cost of borrowing on the card, if you don't pay the. Select reviews three simple steps you can follow to choose the best credit card that provides you with the most benefit. We choose from of the top travel and cash rewards credit cards based on your spending habits and lifestyle. Find the best credit card offers and apply today. This comprehensive guide aims to simplify the process, providing you with the knowledge and tools to choose the credit card that best suits your needs. You can quickly narrow down the choices by carefully assessing your particular needs and what it is you want to accomplish by getting a new credit card. The easiest card to get will depend on your credit score and history. Those with excellent credit will find most cards easy to get. Those who don't will have an. There are different types of credit cards, and the right one for you will depend on what you want to achieve. Do you have a low or limited credit history, and. Determine whether a low interest card is what you're looking for or a card with more substantial rewards. If you're unsure how to decide - or trying to learn. The idea is to figure out how credit cards can work best for you and your financial situation to help you achieve your goals. Checklist of what to look out for when choosing a credit card · Annual Percentage Rate (APR). This is the cost of borrowing on the card, if you don't pay the. Select reviews three simple steps you can follow to choose the best credit card that provides you with the most benefit. We choose from of the top travel and cash rewards credit cards based on your spending habits and lifestyle. Find the best credit card offers and apply today.

The best way to narrow down credit cards and issuers is to ask yourself and issuers the right questions. For instance, when inquiring about a card, ask them to. Find the best credit cards by comparing a variety of offers for balance transfers, rewards, low interest, and more. Apply online at sarahtpoetess.ru Now that you know what the best first credit card should offer, you can research and compare rates, fees, credit limits and rewards to find the card that works. How to Decide What Kind of Credit Card to Get · 1. Do you have good or excellent credit? If the answer is no, focus on finding a no annual fee credit card that. Take an honest look at your credit score and your spending. Look over the cards that may be available to you and choose the one that best. Ready to sort through all the noise? Here are four tips for choosing the right credit card. Tip 1: Identify Interest Rates. What do I need to provide when applying for a credit card? · Proof of income (pay stubs) · Social security number · Valid ID or Passport · Co-signer agreement . Here are some steps you can take to choose the right credit card and how your credit score comes into play when you apply. Rewards credit cards are a great way to earn more on your everyday spending. Select outlines four factors to consider before choosing your next one. Credit cards are useful tools, especially when you choose the right type of card for your needs. Learn how to compare credit cards to find the one that works. The first step in determining the best credit card to apply for is to figure out where you stand credit-wise. Choosing a credit card boils down to knowing what you want out of it, knowing what you qualify for and shopping around for the best offer. If you have good credit — also in the range of or up, rewards credit cards may be right for you. But remember, like any other credit card, a rewards card is. 10 Questions to Ask When Choosing a Credit Card. Selecting the right card is easy with these key questions. Choosing the right credit card depends online on 4 factors - What features do you want? How much are you willing to pay? & How much do you plan to spend? Start with your credit score. This magic number is an indication of your creditworthiness. Things like your payment history and credit usage help determine. WHAT TYPE OF CREDIT CARD IS BEST FOR ME? · 1. You want to reduce the cost of existing card debts · 2. You want to build up a stronger credit history and rating. Choosing a credit card · If you can pay the full balance each month. Consider a credit card with more interest-free days. · If you can't pay the full balance. We'll walk you through the steps to take to choose the right card for you. Know your credit score. First thing's first - what's your credit score? The best credit cards can help you earn rewards, build credit or manage debt. When you're shopping for a card, consider the goals you're trying to reach.

Wtia

The Washington Technology Industry Association (WTIA) revealed the 33 startups based in Washington state participating in its 10th Founder Cohort Program. Wtia Workforce Institute. Issaquah, WA; Tax-exempt since July ; EIN: Subscribe. Receive an email when new data is available for this. WTIA Workforce Institute, also known as Apprenti, will help 11 regions across the country develop their local technology workforce. Find the latest WISDOMTREE sarahtpoetess.ru ACC (sarahtpoetess.ru) stock quote, history, news and other vital information to help you with your stock trading and. Sara Jones, TMMBA Assistant Director The Washington Technology Industry Association (WTIA) is one of the largest statewide tech trade associations in North. Washington Technology Industry Association is the largest statewide association of technology companies and executives in the nation. WTIA is a consortium that includes a not-for-profit member trade association, a not-for-profit tech apprenticeship intermediary, and a for profit. WTIA is Washington state's unifying voice for the technology community. We mobilize industry, education and government to make our region the leading. WTIA is an influential co-op of tech companies large and small. They are pragmatic partners with education and government leaders building a better world. The Washington Technology Industry Association (WTIA) revealed the 33 startups based in Washington state participating in its 10th Founder Cohort Program. Wtia Workforce Institute. Issaquah, WA; Tax-exempt since July ; EIN: Subscribe. Receive an email when new data is available for this. WTIA Workforce Institute, also known as Apprenti, will help 11 regions across the country develop their local technology workforce. Find the latest WISDOMTREE sarahtpoetess.ru ACC (sarahtpoetess.ru) stock quote, history, news and other vital information to help you with your stock trading and. Sara Jones, TMMBA Assistant Director The Washington Technology Industry Association (WTIA) is one of the largest statewide tech trade associations in North. Washington Technology Industry Association is the largest statewide association of technology companies and executives in the nation. WTIA is a consortium that includes a not-for-profit member trade association, a not-for-profit tech apprenticeship intermediary, and a for profit. WTIA is Washington state's unifying voice for the technology community. We mobilize industry, education and government to make our region the leading. WTIA is an influential co-op of tech companies large and small. They are pragmatic partners with education and government leaders building a better world.

WTIA Founder Cohort program helps venture-scale, seed-stage startups grow and scale over the course of 6 months. WTIA and their partners will provide. Read the WTIA press release below to learn more. —. About the Anti-Racism in Tech Pact. The tech sector creates millions of high wage, meaningful jobs across. WTIA is the unifying voice for the technology community in Washington state. We inform and motivate industry, education and government professionals to help. Whole they say they don't intendant ite to replacement wtia that is absolutely what will happen. Most retailers will not understand and or care. Unlock the power of membership! Join WTIA and access a world of opportunities, resources, and connections. It's time to turn inspiration into action. Explore. The price of Trestle Wrapped TIA (WTIA) is calculated in real-time by aggregating the latest data across 1 exchanges and 1 markets, using a global volume-. UPDATE: the slide deck from WTIA's Founder Cohort 11 Legal Workshop (held 05/02/24) is now available! “Patent Bar Date Dangers, Provisional Applications. WTIA. The link was not copied. Your current browser may not support copying via this button. Link copied successfully. Copy link. Collapse; Expand. Product. Looking for online definition of WTIA or what WTIA stands for? WTIA is listed in the World's most authoritative dictionary of abbreviations and acronyms. WTIA (k) Information. WTIA Personal Insurance Information. WTIA Business Insurance Information. WTIA Blog. SIMON Training Videos. Vimly Benefit Solutions. As one of the largest tech organizations in Washington state, the WTIA (Washington Technology Industry Association) has been serving the needs of the tech. Apprenti is a program of the WTIA Workforce Institute. The WTIA Workforce Institute is a c3 organization created to address the workforce shortage in the. WTIA is excited to announce #SeattleAIWeek from June ! Join us for a series of events organized by the Seattle tech community, showcasing. Michael Schutzler is the CEO of WTIA, the largest technology association in Washington state. Michael brings over 30 years of experience in the technology. WTIA supports, supplements and prepares the communities we serve to create jobs and economic prosperity for West Tennessee. An easy way to get WisdomTree Europe Equity Income UCITS ETF Acc real-time prices. View live WTIA stock fund chart, financials, and market news. Washington Technology Industry Association (WTIA), Seattle, Washington. likes · 70 were here. WTIA is a consortium that includes a not-for-profit. Washington Technology Industry Association The Washington Technology Industry Association (WTIA) (formerly Washington Software Alliance) is a prominent. Washington Technology Industry Association (WTIA) -. Here you'll find information about their portfolio and investments.

What To Look For When Buying Options

As such, purchased call options are a bullish strategy. To understand how buying call options might play out, let's look at an example. Entering the Trade. In buying call options, the investor's total risk is limited to the premium paid for the option. Their potential profit is, theoretically, unlimited. It is. It is important to recognize if implied volatility is relatively high or low, because it helps determine the price of the option premium. Knowing if the premium. When it comes to options trading, there is a lot of jargon that investors need to know to navigate this investment strategy successfully. Here's a look at some. If that's not an option, ask the dealer to bring the car for inspection at a facility you choose. If a dealer won't allow an independent inspection, consider. In other words, the price of the option is based on how likely, or unlikely, it is that the option buyer will have a chance to profitably exercise the option. Incorporating options into your trading strategy gives you the ability to implement additional strategies such as: Buying the right to purchase a stock at a. You can check the “Style” of any option contract in the Level 1 quote window in the Questrade Edge platforms. Why do people trade options? While there's no. That may seem like a lot of stock market jargon, but all it means is that if you were to buy call options on XYZ stock, for example, you would have the right to. As such, purchased call options are a bullish strategy. To understand how buying call options might play out, let's look at an example. Entering the Trade. In buying call options, the investor's total risk is limited to the premium paid for the option. Their potential profit is, theoretically, unlimited. It is. It is important to recognize if implied volatility is relatively high or low, because it helps determine the price of the option premium. Knowing if the premium. When it comes to options trading, there is a lot of jargon that investors need to know to navigate this investment strategy successfully. Here's a look at some. If that's not an option, ask the dealer to bring the car for inspection at a facility you choose. If a dealer won't allow an independent inspection, consider. In other words, the price of the option is based on how likely, or unlikely, it is that the option buyer will have a chance to profitably exercise the option. Incorporating options into your trading strategy gives you the ability to implement additional strategies such as: Buying the right to purchase a stock at a. You can check the “Style” of any option contract in the Level 1 quote window in the Questrade Edge platforms. Why do people trade options? While there's no. That may seem like a lot of stock market jargon, but all it means is that if you were to buy call options on XYZ stock, for example, you would have the right to.

Things to consider when choosing an option · The expiration date is displayed just below the strategy and underlying security. · The strike prices are listed high. Consider a hypothetical stock that's trading exactly at its strike price. If the stock is trading at $25, the 25 calls and the 25 puts would both be exactly at. While this play grants you the right to purchase shares at a set price within a set time, it comes at a cost, aka the option's premium. This strategy is often. The cost to enter the trade is called the premium. Market participants consider multiple factors to assess the value of an option's premium, including the. Narrow bid-ask spreads are generally preferable, as they indicate that the market for the option is more liquid. An option contract gives the owner the right, but not the obligation, to buy or sell an underlying asset for a specific price within a specific time frame. When buying a put, you want to look for options with a high delta, which measures the sensitivity of the option price to changes in the underlying asset price. Investing in options can help with risk management and speculation. In terms of risk management, investors can use options to hedge price movements of the. Where an option gets its price can seem like smoke and mirrors when first learning about option trading, but it is actually pretty simple. Option value. U.S. investors can trade options on a wide range of financial products—from individual stocks or stock exchange-traded funds (ETFs) to indexes, foreign. Points to know · Options trading gives you the right to take a specific investment action in the future if it benefits you—or let it expire if it doesn't. When To Buy and When To Sell Options? As you gain more experience with trading options, you'll get a feel for when to buy or sell them. Buying options is most. Options involve risk and are not suitable for all investors. Certain requirements must be met to trade options. Before engaging in the purchase or sale of. Call And Put Options – A Buying And Selling Guide Structurally speaking, call and put options are relatively simple. A put option allows an investor to sell a. The cost to enter the trade is called the premium. Market participants consider multiple factors to assess the value of an option's premium, including the. Beginner investors should first get comfortable with investing in stocks before they consider buying options. Options can help advanced investors to limit their. A Call option investor is looking to take advantage of the stock movement without investing a large amount of capital to own the stock. Buy a Call only when. As a starting point, consider a LEAPS call that is at least 20% of the stock price in-the-money. (For example, if the underlying stock costs $, buy a call. Because you're buying the right to buy a stock, options trade for pennies on the dollar relative to the share price of the stock. This leverage – the ability to.

Pull Money Off Credit Card

Many people use an ATM to get a cash advance. You only need to insert your credit card and enter the PIN. If you don't remember the PIN or never set one, you. Credit card cash withdrawals are simple. You can just go to an ATM and take the cash that you need. Let us understand credit card cash withdrawals. Here's a tip on how to take cash from your credit card · Create the account and link your checking account to receive funds. · Make an invoice. Q: Can I use my prepaid card, gift card or credit card at an ATM? A: Yes. You may withdraw cash against the balance on most Mastercard prepaid and gift cards. Cash advance fee: This is the fee charged every time you withdraw cash using your Credit Card. Typically, it ranges from % to 3% of the transaction amount. What is the process for withdrawing money from my credit card? · Go to any ATM that is compatible with the variant of your Credit Card i.e. Visa, Master or. A credit card cash advance is a withdrawal of cash from your credit card account. Essentially, you're borrowing against your credit card to put cash in your. You can get this money outside of regular banking hours using an ATM. It's the same speed as withdrawing money using your debit card. No application or credit. What is the maximum cash advance limit you can withdraw from a credit card? Cash advances are typically capped at a percentage of your card's credit limit. Many people use an ATM to get a cash advance. You only need to insert your credit card and enter the PIN. If you don't remember the PIN or never set one, you. Credit card cash withdrawals are simple. You can just go to an ATM and take the cash that you need. Let us understand credit card cash withdrawals. Here's a tip on how to take cash from your credit card · Create the account and link your checking account to receive funds. · Make an invoice. Q: Can I use my prepaid card, gift card or credit card at an ATM? A: Yes. You may withdraw cash against the balance on most Mastercard prepaid and gift cards. Cash advance fee: This is the fee charged every time you withdraw cash using your Credit Card. Typically, it ranges from % to 3% of the transaction amount. What is the process for withdrawing money from my credit card? · Go to any ATM that is compatible with the variant of your Credit Card i.e. Visa, Master or. A credit card cash advance is a withdrawal of cash from your credit card account. Essentially, you're borrowing against your credit card to put cash in your. You can get this money outside of regular banking hours using an ATM. It's the same speed as withdrawing money using your debit card. No application or credit. What is the maximum cash advance limit you can withdraw from a credit card? Cash advances are typically capped at a percentage of your card's credit limit.

How to Withdraw Money from a Credit Card - Cash Advances Explained · Consumers can use their credit cards to get cash out of an ATM provided they have a PIN. The Express Cash and Cash Advance programs allow you to use your Card along with a Personal Identification Number (PIN) to withdraw cash at participating. As cash transactions can incur more interest and fees than other transactions, credit card providers usually protect you by limiting the amount of cash you can. If you've received convenience checks linked to your American Express card, you can use them to take a cash advance. Write one to yourself and take it to your. Before you rush to withdraw money from an ATM using your credit card, know that it comes at a high cost. Select explains why it's not recommended. Most debit cards also can be used to withdraw cash at ATMs (automated teller machines). Why do people use debit cards? For many people, it is more convenient to. Most debit cards also can be used to withdraw cash at ATMs (automated teller machines). Why do people use debit cards? For many people, it is more convenient to. How do cash advances work? · 1. At an ATM: You'll need your credit card's PIN to take out cash from an ATM. · 2. At your bank: You'll need proper identification. If you've received convenience checks linked to your American Express card, you can use them to take a cash advance. Write one to yourself and take it to your. However, in some instances, it may take up to 3 business days. For new accounts it takes 14 business days from opening. Your Direct Deposit Cash Advance amount. Digital payment services like Venmo and PayPal are great ways to get a cash advance without a pin. Link your credit card to your digital account, and the funds. A cash advance is when you use your credit card to obtain cash, such as from an ATM or bank branch. But there are others types of transactions that are also. You'll want to follow the instructions to withdraw the cash, acknowledge that you accept the fees associated with the cash advance and collect your money. To. Credit Card use at: ATM; Bank teller; Wells Fargo Online (sarahtpoetess.ru) or through the Wells Fargo mobile app. Cash-like transactions, such. Getting a cash advance from an ATM is one of the most common methods of accessing your credit limit. Other options include visiting a bank branch, calling. Credit products used for cash advances may be subject to additional charges. This includes cash advance fees and interest charges that will accrue on the. Cash advance fee: This is the fee charged every time you withdraw cash using your Credit Card. Typically, it ranges from % to 3% of the transaction amount. Your credit limit can range from Fees will apply when using your credit card at any ATM to perform a cash advance or when using a credit card to withdraw cash. Many credit card companies allow you to withdraw money from your card through a cash advance. · Depending on the card, you may be able to withdraw cash by. You can get a cash advance online, at an ATM or at a bank teller. Please note that to get a cash advance online, you'll need to have a USAA checking or savings.

How Much Is A Bank Of America Checking Account

You must make an opening deposit of at least $ for this checking account. You'll earn no interest. The monthly service fee is $12 unless you meet one of. The business account bonuses, at a 4% return on deposit, are equal to the median return among other business checking bonuses we track. So, although you may. The SafeBalance Banking account has a monthly maintenance fee of $ that is waived for account owners under age 25 and customers enrolled in Bank of. Transfers require enrollment in the service and must be made from an eligible Bank of America consumer or business deposit account. Regular account fees apply. Key Takeaways · Monthly maintenance fee waived. · $ minimum opening deposit. · No ATM fees. · Bill pay. Transfers can be set up between your Bank of America accounts, Merrill Edge accounts or your accounts at other banks Fees apply to wires and certain transfers. Bank of America is now charging $12 a month if you have under $ in your checking account: r/povertyfinance. Plus, no monthly maintenance fee for SafeBalance Banking® account owners under 25 and this account has no overdraft fees. Ready to open a Bank of America. $ each month. You can avoid the Monthly Maintenance Fee when you meet ONE of the following requirements during each statement cycle. You must make an opening deposit of at least $ for this checking account. You'll earn no interest. The monthly service fee is $12 unless you meet one of. The business account bonuses, at a 4% return on deposit, are equal to the median return among other business checking bonuses we track. So, although you may. The SafeBalance Banking account has a monthly maintenance fee of $ that is waived for account owners under age 25 and customers enrolled in Bank of. Transfers require enrollment in the service and must be made from an eligible Bank of America consumer or business deposit account. Regular account fees apply. Key Takeaways · Monthly maintenance fee waived. · $ minimum opening deposit. · No ATM fees. · Bill pay. Transfers can be set up between your Bank of America accounts, Merrill Edge accounts or your accounts at other banks Fees apply to wires and certain transfers. Bank of America is now charging $12 a month if you have under $ in your checking account: r/povertyfinance. Plus, no monthly maintenance fee for SafeBalance Banking® account owners under 25 and this account has no overdraft fees. Ready to open a Bank of America. $ each month. You can avoid the Monthly Maintenance Fee when you meet ONE of the following requirements during each statement cycle.

Bank of America Business Advantage Fundamentals Banking · Bank of America Business Advantage Relationship Banking · Bank of America Advantage SafeBalance Banking. Bank of America's Advantage Savings account comes with an $8 monthly maintenance fee. Bank of America also imposes a withdrawal fee of $10 should you go over. To help you avoid fees, we won't authorize ATM withdrawals or everyday debit card purchases when you don't have enough money in your account at the time of the. But it also has higher fees and a smaller ATM network than many other banks. And you'll need to deposit at least $ to open the account. If you're looking for. Find information on rates and fees for your Bank of America accounts. Learn about monthly maintenance fees, ways to help avoid overdraft fees, and more. Pay $ or $0 monthly maintenance fees. Waive fees in multiple ways. Access automated financial tools. Track your spending, set up account alerts and utilize. Bank of America requires a $25 minimum opening deposit for the most basic Bank of America checking account and $ for the other two tiers of checking. fees associated with business checking and savings accounts from Bank of America America relationship customer is an account owner of a deposit account. Bank of America offers two business checking accounts: the Business Fundamentals Account and the Business Advantage Checking Account. Both are competitively. Please see the Personal Schedule of Fees for more information on how to link eligible accounts to avoid the Monthly Maintenance Fee. For new accounts, we will. Fundamentals™ Banking. Relationship Banking. Second Business Advantage Banking account. $16/month. $0/month. Business Advantage Savings account. $10/month. Bank of America Advantage SafeBalance Banking has a $25 minimum opening deposit and a $ monthly maintenance fee which is waived if you do one of the. There are no overdraft fees and no monthly maintenance fee for accounts with an owner under Please view your Personal Schedule of Fees for details and other. That minimum balance requirement is going up to $20, in November. I had an Advantage Interest Tiered checking account subject to the $10, Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Choose the best account for you and enjoy Online Banking, Mobile Banking Footnote[1], a debit card with Total Security Protection ® - and much more. Using Online Banking or Mobile Banking, you can access your Bank of America checking, savings accounts, CD, IRA, credit card, mortgage and line of credit. Wells Fargo doesn't charge you to open a checking account, but there are monthly service fees. Your banker can suggest ways to get rid of the. The Bank of America Advantage Plus Banking® account comes with many common checking account fees, such as a $12 monthly fee and an overdraft fee of $10 per item. Bank of America Advantage SafeBalance Banking is a “checkless” checking account, which means users cannot write personal paper checks. Account holders can send.