sarahtpoetess.ru

Market

Top Ca Universities

See the top-ranked programs at the University of Alberta at a glance and find university rankings information. The University of Alberta is in the top 5 for. 20 Best Colleges in Southern California for · 1. California State University – Long Beach · 2. University of California – Riverside · 3. Soka University of. Maclean's University Rankings · Canada's Best Primarily Undergraduate Universities: Rankings · Canada's Best Comprehensive Universities: Rankings UC Davis · The Year of the Eggheads · California's College Town · Main Campus · Bodega Marine Lab · UC Davis Health · Tahoe Environmental Research Center · In the. Quick Facts about California · Academy of Art University · University of California, Berkeley · University of Southern California · University of California. University of California, Los Angeles (UCLA) is one of the top public universities in Los Angeles, United States. It is ranked #42 in QS World University. Stanford University · California Institute of Technology · University of California, Berkeley · University of California, Los Angeles · University of Southern. 5 Popular Private Colleges in California · 1. Stanford University · 2. University of Southern California · 3. California Institute of Technology · 4. Pomona College. Best universities in California · 1. Stanford University · 2. California Institute of Technology · 3. University of Southern California. See the top-ranked programs at the University of Alberta at a glance and find university rankings information. The University of Alberta is in the top 5 for. 20 Best Colleges in Southern California for · 1. California State University – Long Beach · 2. University of California – Riverside · 3. Soka University of. Maclean's University Rankings · Canada's Best Primarily Undergraduate Universities: Rankings · Canada's Best Comprehensive Universities: Rankings UC Davis · The Year of the Eggheads · California's College Town · Main Campus · Bodega Marine Lab · UC Davis Health · Tahoe Environmental Research Center · In the. Quick Facts about California · Academy of Art University · University of California, Berkeley · University of Southern California · University of California. University of California, Los Angeles (UCLA) is one of the top public universities in Los Angeles, United States. It is ranked #42 in QS World University. Stanford University · California Institute of Technology · University of California, Berkeley · University of California, Los Angeles · University of Southern. 5 Popular Private Colleges in California · 1. Stanford University · 2. University of Southern California · 3. California Institute of Technology · 4. Pomona College. Best universities in California · 1. Stanford University · 2. California Institute of Technology · 3. University of Southern California.

Private Colleges and Universities · National University () · University of Southern California () · West Coast University Los Angeles () · The. Universities & Colleges in California, USA – Rankings, Courses, Fees ; Stanford University · Stanford, California · Courses · ₹ L - Cr · #1. Cal State Fullerton is a university of significance, ranked as a top institution in the nation and recognized as a leader within the California State. CSULB is a large, urban, comprehensive university in the campus California State University system. California University Ranking ; 1 · 2 · 3 ; Stanford University · University of California, Berkeley · University of California, Los Angeles ; Stanford. Best universities in California · 1. Stanford University · 2. California Institute of Technology · 3. University of Southern California. UC Santa Barbara is a leading center for teaching and research located on the California coast - truly a learning and living environment like no other! Forbes' List of America's Top Colleges ; 21, University of California, San Diego, CA ; 22, California Institute of Technology, CA ; 23, Wellesley College, MA ; Leading at the intersection of innovation and social justice. A global research university with an uncommon emphasis on undergraduate research and education, UC. Best universities in California · 1. Stanford University · 2. California Institute of Technology · 3. University of Southern California. University of Southern California is among the top universities in the country, and keeps getting better. The professors at the university are all at the top of. Welcome to the University Park Campus. Updated: Thursday, August 15, at 6 a.m. PT. All main entry points are open. Main pedestrian entrances are. The best colleges in California include major public research institutions like UC Berkeley, UCLA, and UC San Diego. Private universities like Stanford and. University of California, Los Angeles · About · Rankings · World University Rankings · Arts and Humanities · Business and Economics One of the world's leading research and teaching institutions. Catalyzing discovery, accelerating solutions, sustaining life on Earth, and preparing. UCLA tops all public universities in the U.S. News & World Report rankings. © Regents of the University of California · Emergency · Accessibility. The University California San Diego is one of the world's leading public research universities, located in beautiful La Jolla, California. Founded in , UC Irvine is a member of the prestigious Association of American Universities and is ranked among the nation's top 10 public universities by. Anyways, Princeton by far has the best combined academics and athletic competitiveness of all these schools (men or women) and regularly. It utilizes a semester-based academic calendar. California State University—Los Angeles' ranking in the edition of Best Colleges is Regional Universities.

Ein Credit

Some credit card issuers may hesitate to approve business credit card applications using only an Employer Identification Number (EIN) due to the absence of a. EIN Only. How can you get business credit without a DUNS Number or your Social Security Number? The answer is your use your EIN instead on the credit. Do business credit card run your personal credit even if you have EIN? Help Needed / Question. I have Chase ink card but the promotional. 1. Incorporate Your Business · 2. Get Your EIN · 3. Open a Business Bank Account · 4. Make Payments from Your Business Accounts · 5. Get a Business Credit Card · 6. You can apply for a small business credit card. The application gives you the option to enter your Social Security number instead of an EIN (Employer. You can use EIN to apply for a credit card. You can also apply for a small business loan to begin to build the credit associated with your EIN. You don't always need an EIN to get approved for a business credit card. In fact, sole proprietors often get approval after applying for a business card with. (EIN) issued by the IRS. For sole proprietors, this is most likely your Credit limits on business credit cards are typically higher than on personal credit. In summary. No matter the size or scope of your business, you may be eligible for a business credit card. If you don't have an EIN, you can use your Social. Some credit card issuers may hesitate to approve business credit card applications using only an Employer Identification Number (EIN) due to the absence of a. EIN Only. How can you get business credit without a DUNS Number or your Social Security Number? The answer is your use your EIN instead on the credit. Do business credit card run your personal credit even if you have EIN? Help Needed / Question. I have Chase ink card but the promotional. 1. Incorporate Your Business · 2. Get Your EIN · 3. Open a Business Bank Account · 4. Make Payments from Your Business Accounts · 5. Get a Business Credit Card · 6. You can apply for a small business credit card. The application gives you the option to enter your Social Security number instead of an EIN (Employer. You can use EIN to apply for a credit card. You can also apply for a small business loan to begin to build the credit associated with your EIN. You don't always need an EIN to get approved for a business credit card. In fact, sole proprietors often get approval after applying for a business card with. (EIN) issued by the IRS. For sole proprietors, this is most likely your Credit limits on business credit cards are typically higher than on personal credit. In summary. No matter the size or scope of your business, you may be eligible for a business credit card. If you don't have an EIN, you can use your Social.

Do I need an EIN or federal tax ID number in order to get credit in the name of my business? Answer: No, you do not need an EIN or a federal tax ID number in. Get a business credit report from Experian. Run a free business search. Check company credit reports to help reduce credit risk. Fast, reliable & secure. 1. Register the Business and Obtain an EIN · 2. Open a Business Bank Account · 3. Establish a DUNS Number · 4. Consider a Business Credit Card · 5. Establish Vendor. The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the. Join thousands of top business leaders today. No personal guarantee or personal credit check required. Checking and card services provided by Webster Bank. Do business credit card run your personal credit even if you have EIN? Help Needed / Question. I have Chase ink card but the promotional. How to get Business Credit & Funding using EIN and without using your SSN or personal collateral: Discover the Secrets And Power of Business Credit [Kabinga. Establishing your business credit card with an EIN is a relatively simple process: just sign up for an EIN, then use it in place of your Social Security number. How to Get Business Credit. Once you have established your business identity by applying for an EIN through the IRS, establishing your free D-U-N-S number with. 1. Incorporate Your Business · 2. Get Your EIN · 3. Open a Business Bank Account · 4. Make Payments from Your Business Accounts · 5. Get a Business Credit Card · 6. You don't always need an EIN to get approved for a business credit card. In fact, sole proprietors often get approval after applying for a business card with. No, because loans to business will always require a personal guarantee. If you default on a loan or stop paying your credit card, they have zero. Join thousands of top business leaders today. No personal guarantee or personal credit check required. Checking and card services provided by Webster Bank. Apply for an Employer ID Number (EIN) · Check Your Amended Return Status · Get Note: The Renewal Community Employment Credit (Carry forward only) credit was. We run a credit check to verify your identify and determine eligibility for service financing. Your security is our priority. We have enhanced our processes. If you want to get a line of credit for your EIN and withhold your SSN, as you probably guessed, you need to find a lender that does not require a personal. The short response is yes: you can apply for specific business Mastercards utilizing only your EIN. EIN-just cards are extraordinary for. PNC Cash Rewards® Visa Signature® Business Credit Card. Reward Your Business Spending With Cash Back. Earn % cash back on net purchases*. Find small business credit cards with cash back, airline and travel rewards points. Shop for a new credit card that fits your business needs and apply. How to Get Business Credit. Once you have established your business identity by applying for an EIN through the IRS, establishing your free D-U-N-S number with.

Fixed Amount Credit Card

Exceeding the limit may require the credit card holder to pay a credit limit fee. At the end of the month, the credit card holder can choose to repay the entire. And second, because credit card balances were growing, the minimum payment amount catches up with the fixed payment amounts that some people set. Contrary to. Typically, your minimum payment is the greater of a certain percentage of your balance (1% or 2%) or a flat minimum payment (such as $25 or $35). For smaller. The minimum amount that a credit card company requires you to pay toward your debt each month. Negative Amortization. When your minimum payment toward a debt is. You pay a fixed percentage of your balance each month. This can be anything from % to 99%. We'll collect at least the minimum payment each month, even if. Each day, you'll have a new daily balance, and the credit card issuer will calculate the interest on this amount. The daily interest charges are all added. Minimum payments are calculated differently bank by bank. Typically, your minimum payment is the greater of a certain percentage of your balance (1% or 2%) or a. A credit card minimum payment is the smallest amount due each monthly billing cycle. Paying the minimum on time can help you avoid penalties and fees. This is a common type of interest rate that generally stays the same over time, even if market conditions change. There are exceptions, however – as some cards. Exceeding the limit may require the credit card holder to pay a credit limit fee. At the end of the month, the credit card holder can choose to repay the entire. And second, because credit card balances were growing, the minimum payment amount catches up with the fixed payment amounts that some people set. Contrary to. Typically, your minimum payment is the greater of a certain percentage of your balance (1% or 2%) or a flat minimum payment (such as $25 or $35). For smaller. The minimum amount that a credit card company requires you to pay toward your debt each month. Negative Amortization. When your minimum payment toward a debt is. You pay a fixed percentage of your balance each month. This can be anything from % to 99%. We'll collect at least the minimum payment each month, even if. Each day, you'll have a new daily balance, and the credit card issuer will calculate the interest on this amount. The daily interest charges are all added. Minimum payments are calculated differently bank by bank. Typically, your minimum payment is the greater of a certain percentage of your balance (1% or 2%) or a. A credit card minimum payment is the smallest amount due each monthly billing cycle. Paying the minimum on time can help you avoid penalties and fees. This is a common type of interest rate that generally stays the same over time, even if market conditions change. There are exceptions, however – as some cards.

Fixed rate as low as % APR or Variable rate as low as % APR; Credit limits up to $4,; No cash advance fee & No balance transfer fee; Debt. Exceeding the limit may require the credit card holder to pay a credit limit fee. At the end of the month, the credit card holder can choose to repay the entire. This can be anything from % to 99%. We'll collect at least the minimum payment each month, even if your fixed percentage amount falls below this. 4. An. Get a first-year annual fee rebate for you and up to three Authorized Users† and earn 10% cash back for the first 4 statements on net purchases of up to $2,†. 17 (1) This section applies to loans for fixed amounts of credit, except mortgage or hypothec loans. · (2) A borrower under a credit agreement may prepay · (3) A. Pay off your larger credit card purchases in smaller, manageable monthly payments at a lower interest rate. Learn more about Instalments and how you can save. BankAmericard® Credit Card: Best feature: 18 billing cycle introductory rate on purchases and balance transfers. · Discover it® Balance Transfer: Best feature. b) Minimum payment is the lowest amount you need to pay by the due date to keep your account in good standing. It includes any monthly installment payments due. After the intro APR offer ends, a Variable APR that's currently % - % will apply. 3% † Intro balance transfer fee for the first 60 days your account. Your credit card company must send you a notice 45 days before they can increase your interest rate; change certain fees (such as annual fees, cash advance fees. Paying more than the minimum will reduce the interest you owe on your credit card balance. If you pay your balance in full every month, you can avoid interest. A company that enters into a credit agreement for a loan with a variable interest rate for a fixed amount, to be repaid on a fixed future date or by instalment. If your balance is lower than the fixed amount, then the minimum payment may be the entire balance. If you have a higher balance, your minimum payment will. Many balance transfer deals offer 0% interest on the amount you move. But if you are going to continue to use the new credit card for future spending, check. It depends on whether your account has a variable rate. If your credit card account has a variable rate, the credit card rate is tied to an index. Turn eligible credit card purchases of $ or more 1 into monthly installment payments over a fixed period of time with Scotia SelectPay 2 during checkout or. If the dollar amount is higher than the actual balance charged to the card, then the full balance is the minimum payment. The exact details differ from issuer. 17 (1) This section applies to loans for fixed amounts of credit, except mortgage or hypothec loans. · (2) A borrower under a credit agreement may prepay · (3) A. Find out the difference in interest between a fixed payment and the minimum credit card payment with Bankrate's financial calculator. Potentially reduce your interest rate; Consolidate multiple payments into one fixed-rate monthly payment; Set a clear payoff date for your debt. Cons. Approval.

Phone Number For The Irs In Utah

If you have any questions regarding this letter. please call our Customer Service Department at between the hours of AMand PM. Island, South Dakota, Utah, West Virginia, Wyoming ) Catalog Number F Department of the Treasury Internal Revenue Service sarahtpoetess.ru Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in Utah. Salt Lake IRS Office · 50 South East. Salt Lake City, UT · . Call Utah tax lawyer, Jordan Wilcox, at to protect your valuable IRS rights. IRS collection letters all look about the same to the unwary Utah. You can always make a tax payment by calling our voice response system at Follow the prompts to make your payment. What You Need to Know. The. Ogden, UT Residents of Puerto Rico and the U.S. Virgin Islands may contact the IRS toll free at (Hours of Operation are 7 a.m. to. Utah, Washington, Wisconsin and Wyoming. ** Services Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana. General Phone Number or Use these numbers for general inquiries. See below for additional contact numbers. If you have any questions regarding this letter. please call our Customer Service Department at between the hours of AMand PM. Island, South Dakota, Utah, West Virginia, Wyoming ) Catalog Number F Department of the Treasury Internal Revenue Service sarahtpoetess.ru Find IRS mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in Utah. Salt Lake IRS Office · 50 South East. Salt Lake City, UT · . Call Utah tax lawyer, Jordan Wilcox, at to protect your valuable IRS rights. IRS collection letters all look about the same to the unwary Utah. You can always make a tax payment by calling our voice response system at Follow the prompts to make your payment. What You Need to Know. The. Ogden, UT Residents of Puerto Rico and the U.S. Virgin Islands may contact the IRS toll free at (Hours of Operation are 7 a.m. to. Utah, Washington, Wisconsin and Wyoming. ** Services Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana. General Phone Number or Use these numbers for general inquiries. See below for additional contact numbers.

From the website: Pay your taxes. Get your refund status. Find IRS forms and answers to tax questions. We help you understand and meet your federal tax. Request for Taxpayer Identification Number (TIN) and Certification Utah, West Virginia, Wyoming, Internal Revenue Service Center Ogden, UT The Internal Revenue Service is structured to serve customers with similar needs. Ogden IRS Early Learning Center is a licensed child care center. More info: Go. Internal Revenue Service (IRS) Taxpayer Assistance Center can be contacted via phone at for pricing, hours. And the IRS has many offices in Ogden. Map · 25th St. Ste Ogden, UT Directions · () Call Now. To learn about your tax relief options, call () Pearson Butler serves individuals and businesses throughout Utah. Protect Your Immediate & Long-. If you would like to verify that the communication you received is really from the Tax Court please call the Court at () IRS TACs operate by appointment. To schedule an appointment, call To view all services provided at any office and get directions, visit sarahtpoetess.ru Parks and Trails Directory · Recreation Programs · Weber County · Weber call If you do not have an emergency please call non emergency dispatch. Directory of Federal Tax Return Preparers with Credentials and Select Qualifications Contact Your Local Office · Tax Stats, Facts & Figures. Know Your Rights. Customer Service Hours: Monday – Friday, am – pm. Help from tax specialists: [email protected] Taxpayer help line: or If you have any questions regarding this letter, please call our Customer Service Department at 5 between the hours of AM and PM. How to contact us. For answers to questions about charities and other non-profit organizations, call IRS Tax Exempt and Government Entities Customer Account. Form N, U.S. Income Tax Return for Electing Alaska Native Settlement Trusts. Department of the Treasury Internal Revenue Service Ogden, UT Salt Lake IRS Office · 50 South East. Salt Lake City, UT · . Request for Taxpayer Identification Number (TIN) and Certification You can get help with most tax issues online or by phone. On sarahtpoetess.ru you can. Form , Information Return for Tax-Exempt Private Activity Bond Issues, Department of the Treasury Internal Revenue Service Ogden, UT If you have any questions or if the recipient has any questions after reading the instructions on the front and back of the Form W-9, please call Accounts. Alaska ; Department of Treasury Internal Revenue Service Ogden, UT ; Internal Revenue Service P O Box Cincinnati, OH visiting the IRS website at sarahtpoetess.ru or by calling toll-free at. TAX-FORM (). If you have any questions, please call us toll free at

Cc Credit

Please Note: The course we offer is Credit Counseling which is the FIRST course that is taken BEFORE filing bankruptcy. Credit Counseling is MANDATORY. Your. You must submit a Transfer Credit Evaluation Form to the Admissions & Records Office to have your transcripts reviewed for transfer credit. Online loans. Quick. Be approved for an online loan up to $3, in minutes. Have cash in your bank account as soon as today.*. CONTACT DETAILS Credit for Prior Learning (CPL) is an opportunity to demonstrate knowledge that you have gained through a variety of experiences such as. On average, community college students lose about 13 credits following their first transfer. That's nearly a whole semester of study. That's precious time and. NC Community College Transfer Guides. Transfer Guides serve as advising and degree planning tools for students at North Carolina Community Colleges who plan to. Need cash fast? An online line of credit is an easy way to borrow money from CC Flow. Only pay on the cash borrowed and only for the time you need it. Laurentian Bank offers a variety of credit cards that suit your needs, including rewards, cash back, no-fee and low-interest options. Apply now. Need cash fast? Have bad credit? Get your unsecured personal loan fast using our state of the art online loan process. Get Started Here Today! Please Note: The course we offer is Credit Counseling which is the FIRST course that is taken BEFORE filing bankruptcy. Credit Counseling is MANDATORY. Your. You must submit a Transfer Credit Evaluation Form to the Admissions & Records Office to have your transcripts reviewed for transfer credit. Online loans. Quick. Be approved for an online loan up to $3, in minutes. Have cash in your bank account as soon as today.*. CONTACT DETAILS Credit for Prior Learning (CPL) is an opportunity to demonstrate knowledge that you have gained through a variety of experiences such as. On average, community college students lose about 13 credits following their first transfer. That's nearly a whole semester of study. That's precious time and. NC Community College Transfer Guides. Transfer Guides serve as advising and degree planning tools for students at North Carolina Community Colleges who plan to. Need cash fast? An online line of credit is an easy way to borrow money from CC Flow. Only pay on the cash borrowed and only for the time you need it. Laurentian Bank offers a variety of credit cards that suit your needs, including rewards, cash back, no-fee and low-interest options. Apply now. Need cash fast? Have bad credit? Get your unsecured personal loan fast using our state of the art online loan process. Get Started Here Today!

Looking to build credit or earn rewards? Compare our rewards, Guaranteed secured and other Guaranteed credit cards. Fitch's credit ratings do not directly address any risk other than credit risk. CC; C; RD; D. AAA (xxx); AA (xxx); A (xxx); BBB (xxx); BB (xxx); B (xxx); CCC. Earn free college credit in high school. Meet your high school graduation requirements AND earn university transfer credits, complete an associate degree, or. Community College Transfer Guides. Students should follow a guide corresponding to the academic year in which they began attending their community college. A CC credit rating is a non-investment grade rating, implying that a company's bonds are very high-risk. Read our definition to see what it means for. No matter where you may be in your academic career, Clackamas Community College offers a variety of ways to earn college credits. Apply for a Secured Card — Over 1 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit. The easy way to build credit. 13 credits max/course credit. Page 2. • Other formal university or college Other learning activities. ”QAP CC Credit Activity Approval. Form” to be. Some basics on this type of transfer credit: Will only transfer as lower division units and cannot satisfy upper division unit requirements (even if accepted to. A Cash Credit (CC) is a short-term source of financing for a company. In other words, a cash credit is a short-term loan extended to a company by a bank. It. The CareCredit credit card can help pay for health, wellness, and medical costs with special financing options. Learn how it works and apply today! Current students in a degree program at Central Maine Community College can earn up to 75% of their program course requirements through credit for prior. Apply for a Visa credit card - it's a secure and reliable way to pay for what you need, anywhere in the world. Access cash at over 1 million ATMs. Find out the best credit card according to your lifestyle. Compare various options to choose one that has low interest or maximum cash back. The free online credit card checker or CC live checker checks if the credit card is valid or invalid. Enter the credit card number. Click on the. Apply online for a credit card in Canada. Let BMO help find the best credit card for you. Check out limited time welcome offers that give you sign-up. BY: credit must be given to the creator. CC BY-SA. This license enables reusers to distribute, remix, adapt, and build upon the material in any medium or format. Here you will find everything you need to know about tuition and fees for credit classes. Pima provides a variety of options to pay for your tuition. Browse TD Credit Card options that work best for your financial needs. Choose from benefits like cash back, predictable monthly fees, and no annual fee. The total cost of enrollment is based on a charge per credit hour. Tuition is the same for credit and audit courses. The tuition and fee rates are effective for.

Forex Trading Types

Understanding the three main types of forex market analysis – technical, fundamental, and sentiment – can help you construct a stronger trading strategy. The forex exchange market is one of the largest markets around the world and that it is open 24 hours, five days a week. FX pairs are categorized into three types: majors, minors, and exotics. Major currency pairs. As the name suggests, the 'majors' are the most popular traded. TYPES OF FOREX CONTRACTS · 1. Spot Contract · 2. Options · 3. Futures · 4. Exchange Trade Funds. No Dealing Desk; Market Maker; Electronic Communications Network. Each of these three different types of forex brokers have a different way of handling. There are two types of currency options you can trade: puts and calls. Call options in forex. You'd buy a forex call option if you thought the base currency. Forex trading includes several types, including position, swing, scalping, and day trading, each demanding different strategies, and levels of focus from a. Popular trading strategies include trend following, range trading, or breakout trading. Traders who choose this type of trading style need patience and. There are four main types of trading styles: Scalper, Day Trader, Position Trader, Swing Trader. 1. Scalping Scalping is a fast-paced trading style. Understanding the three main types of forex market analysis – technical, fundamental, and sentiment – can help you construct a stronger trading strategy. The forex exchange market is one of the largest markets around the world and that it is open 24 hours, five days a week. FX pairs are categorized into three types: majors, minors, and exotics. Major currency pairs. As the name suggests, the 'majors' are the most popular traded. TYPES OF FOREX CONTRACTS · 1. Spot Contract · 2. Options · 3. Futures · 4. Exchange Trade Funds. No Dealing Desk; Market Maker; Electronic Communications Network. Each of these three different types of forex brokers have a different way of handling. There are two types of currency options you can trade: puts and calls. Call options in forex. You'd buy a forex call option if you thought the base currency. Forex trading includes several types, including position, swing, scalping, and day trading, each demanding different strategies, and levels of focus from a. Popular trading strategies include trend following, range trading, or breakout trading. Traders who choose this type of trading style need patience and. There are four main types of trading styles: Scalper, Day Trader, Position Trader, Swing Trader. 1. Scalping Scalping is a fast-paced trading style.

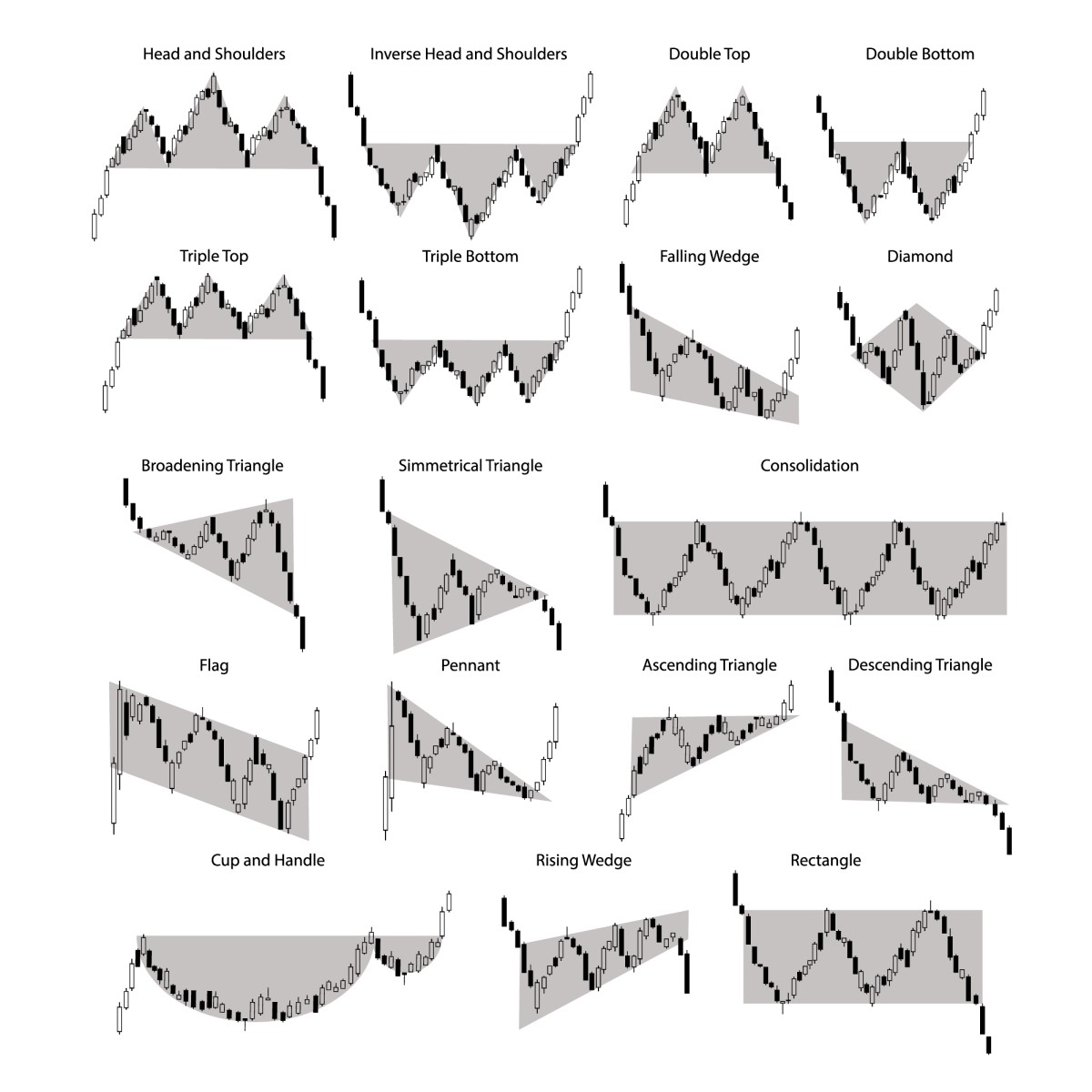

THE THREE DIFFERENT TYPES OF FOREX MARKET: · Spot forex market: the physical exchange of a currency pair, which takes place at the exact point the trade is. An example of a forex trade · If the Euro does go up in value in relation to the U.S. dollar and you'd like to take your profits, you could close your EUR/USD. A forex trading order is an instruction with defined parameters to your broker to take a specific action in the market, either now or in the future. In forex trading, there are two types of currency options—vanilla and exotic. What are these exactly? Let's find out. Advanced forex trading strategies · 1. Bounce strategy · 2. Running out of steam strategy · 3. Breakout strategy · 4. Breakdown strategy · 5. Overbought and oversold. The retail forex market has a wide range of traders and investors, each of whom opts for different techniques, strategies, and goals. Common types of chart patterns · Continuation - these signal a current trend will continue · Reversal - these indicate a trend is going to change direction. An example of a forex trade · If the Euro does go up in value in relation to the U.S. dollar and you'd like to take your profits, you could close your EUR/USD. Different forex traders work with different trading strategies while predicting or making speculations in the forex market. There are four types of entry orders: buy stops, buy limits, sell stops and sell limits. Buy. Buy stops instruct your broker to open a long position on a market. The basic forex order types (market, limit entry, stop entry, stop loss, and trailing stop) are usually all that most traders ever need. To open a position, the. In forex trading, there are two types of currency options—vanilla and exotic. What are these exactly? Let's find out. Currency trading is divided into two parts. The first currency in an forex pair is known as the base. The base currency is the one that a trader thinks will go. The foreign exchange market (forex, FX (pronounced "fix"), or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of. There are three types of charts that forex users rely on for trading: line charts, bar charts, and candlestick charts. Mountain, point and figure charts are. Currency trading is divided into two parts. The first currency in an forex pair is known as the base. The base currency is the one that a trader thinks will go. There are two types of limit orders involved in forex trading: one to open a trade and the other, to close it. However, there's also the risk that your order. Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. No Dealing Desk; Market Maker; Electronic Communications Network. Each of these three different types of forex brokers have a different way of handling.

Best Insurance Ratings Scale

Financial Strength Rating (FSR) Scale The Financial Strength Rating is a statistical assessment of an insurer's ability to meet their ongoing insurance. ratings summarize A.M. Best's opinion on an insurance company's ability to pay claims, debts and other financial obligations in a timely manner. An insurer. List of Possible Ratings · 1. A++. Superior, AAA Extremely Strong, Aaa Exceptional, AAA Exceptionally Strong · 2. A+ Superior, AA+ Very Strong, Aa1 Excellent, AA+. Credit ratings: A.M. Best's active company rating scale ranges from A++ (Superior) to D (Poor). Standard & Poor's active company rating scale ranges from AAA. A.M. Best's active company rating scale ranges from A++ (Superior) to D (Poor). A.M. Best's Financial Strength Rating (FSR) is an independent opinion of an. predictable and stable operating environment, or good financial fundamentals Insurance Financial Strength Ratings. Opinions of the ability of insurance. For example, an A+ from A.M. Best is the next-to-top rating of its 15 categories, but an A+ from Fitch, Kroll or S&P is their 5th-highest rating (out of With the recent turmoil in the financial markets, including challenges faced by various insurance companies, we are receiving a lot of questions about carrier. How does AM best determine its ratings? ; Superior. A+. A++ ; Excellent. A. A- ; Good. B+. B++ ; Fair. B · B-. Financial Strength Rating (FSR) Scale The Financial Strength Rating is a statistical assessment of an insurer's ability to meet their ongoing insurance. ratings summarize A.M. Best's opinion on an insurance company's ability to pay claims, debts and other financial obligations in a timely manner. An insurer. List of Possible Ratings · 1. A++. Superior, AAA Extremely Strong, Aaa Exceptional, AAA Exceptionally Strong · 2. A+ Superior, AA+ Very Strong, Aa1 Excellent, AA+. Credit ratings: A.M. Best's active company rating scale ranges from A++ (Superior) to D (Poor). Standard & Poor's active company rating scale ranges from AAA. A.M. Best's active company rating scale ranges from A++ (Superior) to D (Poor). A.M. Best's Financial Strength Rating (FSR) is an independent opinion of an. predictable and stable operating environment, or good financial fundamentals Insurance Financial Strength Ratings. Opinions of the ability of insurance. For example, an A+ from A.M. Best is the next-to-top rating of its 15 categories, but an A+ from Fitch, Kroll or S&P is their 5th-highest rating (out of With the recent turmoil in the financial markets, including challenges faced by various insurance companies, we are receiving a lot of questions about carrier. How does AM best determine its ratings? ; Superior. A+. A++ ; Excellent. A. A- ; Good. B+. B++ ; Fair. B · B-.

There is no charge for this service because Best bills the rated insurance companies. financial size. Financial Stability Ratings ® (FSRs) are a. An Insurer Financial Strength Rating is our forward-looking opinion about an insurance organization's ability to pay its policies and contracts. Rating definitions ; Standard & Poor's · AAA, extremely strong. AA, very strong ; Moody's · Aaa, exceptional. Aa, excellent ; A.M. Best · A++, A+, superior. A, A-. Pacific Life is our top pick for The Fortune company was founded more than years ago and is rated A+ Superior by A.M. best for financial stability. Best's second-best rating of A+ (for superior) with Fitch's fifth-best rating of A+ (for strong), or A.M. Best's C rating (for weak) with Moody's C (for lowest. Financial strength ratings · A.M. Best · Fitch Ratings · Moody's Investor Service · Standard & Poor's · Comdex ranking: 96 · Related articles. A.M Best's active company rating scale ranges from A++ (Superior) to D (Poor). 3) Please see the Fitch Ratings website for more information on credit rating. A Best's Financial Strength Rating is an independent opinion of an insurer's financial strength and ability to meet its ongoing insurance policy and contract. Fitch's credit rating scale for issuers and issues is expressed using the categories 'AAA' to 'BBB' (investment grade) and 'BB' to 'D' (speculative grade) with. The insurer's financial condition is good and the entity is likely to meet its policyholder obligations, though it may be more susceptible to difficult economic. The others are AM Best, Fitch, and Moody's. Each agency has its own rating scale and categories. Checking how an insurance company is rated by at. Demotech's scale utilizes four main ratings: A (Exceptional), S (Substantial), M (Moderate), and L (Licensed). For its A rating, it may upgrade to A' or A” for. Highest Rated Life Insurance Companies ; Nationwide Life, A+, A+, A1 ; Penn Mutual, A+, A+, Aa3. (The 6th highest of 21 ratings): Insurance companies rated A offer good financial security. However, elements may be present which suggest a susceptibility to. companies, and the meaning of the rating scales of the 5 top rating agencies: A.M. Best, Fitch, Moody's Investment Services, Standard & Poor's, and Weiss. A.M. Best rates insurance and reinsurance companies on a scale that includes seven categories, ranging from “A” to “D.” Ratings are then supplemented with “+”. Find a list of financial rating services that rank insurance companies based on their financial strength and stability A.M. Best Co. Who Are These Rating Companies? Currently there are three major rating agencies that rate the financial strength of the various insurance companies. · A.M. Best. Rated A (Excellent) by AM Best for financial strength and “A+” (Excellent) for long-term issuer credit for a company with a financial size category of X ($ Moody's states that insurance companies rated "A" offer good financial security. The "A" is the third-highest of nine financial strength rating ranges assigned.

Straight Term Life Insurance

AAA Life Term insurance covers a 10 to year period, during which the monthly or annual premium remains the same. But your term policy can change as your. Don't leave your family's financial wellbeing up to chance: term life insurance could help protect your family's finances and ensure that costs like rent. Straight life insurance is a comprehensive and enduring form of coverage that offers a lifetime death benefit, cash value accumulation, and level premiums. Whole life insurance, or whole of life assurance sometimes called "straight life" or "ordinary life", is a life insurance policy which is guaranteed to. Permanent life insurance refers to coverage that never expires, unlike term life insurance, and combines a death benefit with a savings component. more. Related. Unlike permanent life insurance, straight life annuities don't offer a death benefit for your beneficiaries. They payout until you die, and then the payments. Term life insurance provides coverage for a specific period of time, while straight life, covers the insured for life as long as premiums are paid. With term insurance, once you finalize your policy, your premiums are locked in until it expires. For this reason, term life insurance is often appealing to. A straight life insurance policy provides coverage for a lifetime, with constant premiums throughout the policy's term. It is also known as whole life insurance. AAA Life Term insurance covers a 10 to year period, during which the monthly or annual premium remains the same. But your term policy can change as your. Don't leave your family's financial wellbeing up to chance: term life insurance could help protect your family's finances and ensure that costs like rent. Straight life insurance is a comprehensive and enduring form of coverage that offers a lifetime death benefit, cash value accumulation, and level premiums. Whole life insurance, or whole of life assurance sometimes called "straight life" or "ordinary life", is a life insurance policy which is guaranteed to. Permanent life insurance refers to coverage that never expires, unlike term life insurance, and combines a death benefit with a savings component. more. Related. Unlike permanent life insurance, straight life annuities don't offer a death benefit for your beneficiaries. They payout until you die, and then the payments. Term life insurance provides coverage for a specific period of time, while straight life, covers the insured for life as long as premiums are paid. With term insurance, once you finalize your policy, your premiums are locked in until it expires. For this reason, term life insurance is often appealing to. A straight life insurance policy provides coverage for a lifetime, with constant premiums throughout the policy's term. It is also known as whole life insurance.

Convertible Term Insurance -- Term insurance that offers the policyholder the option of exchanging it for a permanent plan of insurance without evidence of. Smaller Death Benefits: Permanent coverage is more expensive than term insurance, so you can only buy a smaller death benefit with the same premium. Fees &. Straight life insurance: Whole life insurance on which premiums are payable for life. Structured settlement: An agreement allowing a person who is. Access to your premiums: With term life insurance, the money you pay to the insurance company in premiums is lost forever (except with a return of premium. Whole life insurance is also referred to as “ordinary life” or “straight life.” It provides coverage for your entire lifetime. · The premium depends on your age. This kind of policy is sometimes described as plain vanilla insurance. You pay a fixed amount, known as a level premium, each payment period (monthly, quarterly. While many people are familiar with the term “paid-up life insurance,” some mistakenly assume that it is a type of policy they can purchase outright—such as. Term Life Insurance policies provide a check to your beneficiary when you die. Term Life Insurance policies generally are cheaper and easier to understand than. Life Income Option - death benefit plus interest paid through a life annuity. Income continues under a straight life income option for as long as the. Term insurance generally offers the largest insurance protection for your premium dollar. There are two basic types of term life insurance policies level term. A straight life annuity, sometimes called a straight life policy, is a retirement income product that pays a benefit until death but forgoes any further. It is often used to protect a long term decreasing debt, such as a home mortgage. Whole life insurance (often referred to as straight life or permanent life) is. The terms “level” and “decreasing” refer to the death benefit amount during the term of the policy. A level term policy pays the same benefit amount if death. Term life is just insurance, whereas whole life also accumulates cash value that you can tap during your lifetime. Whole life premiums can cost approximately In general, straight term insurance provides life insurance coverage for a specific number of years, called the term. The face amount of the policy, or death. Decreasing term life insurance is a term life policy with a death benefit that gets smaller over time. It's beneficial if you expect your loved ones to. If payments are paid on time, the insured individual will be protected for the rest of their life. It also goes by the names straight life as well as ordinary. Essentially, unless the policyowner can afford permanent life insurance and is committed to paying the premiums until the insured's death, term life insurance. Term life insurance covers you for a set period of time, usually 10, 20 or 30 years. If you die within this time frame, your beneficiaries will be paid the. In general, straight term insurance provides life insurance coverage for a specific number of years, called the term. The face amount of the policy, or death.

Reliable Homeowners Insurance

Knowing the difference can help you buy the coverage that's best for you. View more: home insurance tips and videos. Fraud. Protect yourself from contractor. This guide was designed to give you a better understanding about the kind of homeowners and renters insurance that is best for you. Consumer Reports\' homeowners insurance guide answers key questions. CR explains how to buy, own, and use homeowners insurance effectively and economically. You never know when fire, theft or falling trees could damage your home. That's why you need reliable homeowners' coverage. At National General, we'll make. accurate. Stay with the same insurer. If you've kept your coverage with a company for several years, you may receive a special discount for being a long-term. Based on personal experience, and after conducting extensive research, I've learned that State Farm is the best overall homeowners insurance carrier in Florida. Westfield and Erie are the best home insurance companies based on rates, customer complaints, discounts and coverage offerings. Progressive and Nationwide. Our ELP's will get you the right coverage you need to protect your home, so you're getting the best value for the right price. Get a home insurance quote. Enjoy peace of mind by getting a homeowners insurance quote online today, and then customize your coverage with innovative discounts. Knowing the difference can help you buy the coverage that's best for you. View more: home insurance tips and videos. Fraud. Protect yourself from contractor. This guide was designed to give you a better understanding about the kind of homeowners and renters insurance that is best for you. Consumer Reports\' homeowners insurance guide answers key questions. CR explains how to buy, own, and use homeowners insurance effectively and economically. You never know when fire, theft or falling trees could damage your home. That's why you need reliable homeowners' coverage. At National General, we'll make. accurate. Stay with the same insurer. If you've kept your coverage with a company for several years, you may receive a special discount for being a long-term. Based on personal experience, and after conducting extensive research, I've learned that State Farm is the best overall homeowners insurance carrier in Florida. Westfield and Erie are the best home insurance companies based on rates, customer complaints, discounts and coverage offerings. Progressive and Nationwide. Our ELP's will get you the right coverage you need to protect your home, so you're getting the best value for the right price. Get a home insurance quote. Enjoy peace of mind by getting a homeowners insurance quote online today, and then customize your coverage with innovative discounts.

Find the cheapest and best homeowners insurance in California based on thousands of customer reviews. Discover top rated home insurance near you. You have many choices when it comes to homeowners insurance, but Mercury is the smart and best choice with affordable rates, first-class coverages and great. Credible makes it easy to get free customized quotes from top insurance carriers. Compare quotes for homeowners insurance, auto insurance, and more. MarketWatch Guides Home Team has named Security First Insurance the Best Pick for Hurricane Protection in Florida for , , and An illustration of a. Looking for the best homeowner insurance? Consumer Reports has honest ratings and reviews on homeowners insurance from the unbiased experts you can trust. GET DEPENDABLE COVERAGE FOR YOUR HOME AND ITS CONTENTS · CUSTOMIZE YOUR HOME INSURANCE · SAVE MONEY ON YOUR HOMEOWNERS INSURANCE · Your Questions Answered. All homeowners' insurance policies cover the primary home on a property, meaning that most damage from weather, accidents, vandalism, and other events will be. According to our research, State Farm has the cheapest monthly rates on average for homeowners insurance in the U.S. This is based in part on premiums for a. Homeowners of America makes it easy to get the homeowners insurance policy you need to be prepared for whatever comes your way. The Colorado Division of Insurance has created this report, to provide consumers an opportunity to compare auto insurance premium rates in Colorado. Enjoy peace of mind by getting a homeowners insurance quote online today, and then customize your coverage with innovative discounts. We have reviewed and compared the top contenders in the property insurance world: Progressive Insurance, Allstate Insurance, Universal Property Insurance. Looking for the best homeowners insurance? SelectQuote partners with several home insurance companies to find the best home insurance for you. We offer reliable homeowners insurance that can help you and your family in the event of water backup damage, theft, certain natural disasters and more. Best Home Warranty Companies ( Guide) · Best Home Appliance Insurance ( Guide) · Cheapest Home Warranty Companies · American Home Shield Review · Liberty. Homeowners insurance can protect your biggest asset: your home. Learn more about liability limits, interior vs. exterior damage, injury that arises while on. Benavides Insurance offers the best homeowners insurance in Brownsville, TX with comprehensive coverage at affordable rates tailored to your needs. When choosing Mercury, you get one of the best homeowners insurance providers in Texas and a local independent agent who works with you to build a custom. At David Pope Insurance, we can give you a thorough assessment of the best homeowners insurance companies in Missouri to help you find a good match. Protect your home without overpaying for homeowners insurance. AIS provides free quotes for homeowners insurance to find you the best coverage at the lowest.

Top Ten Ways To Invest Money

7 Tips for Spending Money Wisely · How to Become an Investor · What is Best Way to Invest 10K · WorkshopToolbox · Subscription DisclosurePrivacy Policy. By starting to put away money earlier, a year-old investing approximately $ per month ($2,/year) accumulates more assets by age 65 than if he or she. 1. Stocks. Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a. Ten years? Thirty? That timeline is known as your That's why people opt to invest some of their money rather than stash it all in a savings account. Money Market Funds · Cash Solutions & Rates · Annuities · Cryptocurrency · More Manage your investments, place trades, and stay on top of market news with the. The depository bank uses the daily balance method to calculate interest on your deposit account, which applies a daily periodic rate to the principal in your. 1. Stocks. Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a. After you've put a little effort into it, you can feel really good about investing, especially when things go well. ways to sell and get your money? Do. Top 10 Tips for First time investors · 1. Establish a Plan. A to B · 2. Understand Risk. Investment Risk · 3. Be Tax Efficient from the Start. Tax Umbrella · 4. 7 Tips for Spending Money Wisely · How to Become an Investor · What is Best Way to Invest 10K · WorkshopToolbox · Subscription DisclosurePrivacy Policy. By starting to put away money earlier, a year-old investing approximately $ per month ($2,/year) accumulates more assets by age 65 than if he or she. 1. Stocks. Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a. Ten years? Thirty? That timeline is known as your That's why people opt to invest some of their money rather than stash it all in a savings account. Money Market Funds · Cash Solutions & Rates · Annuities · Cryptocurrency · More Manage your investments, place trades, and stay on top of market news with the. The depository bank uses the daily balance method to calculate interest on your deposit account, which applies a daily periodic rate to the principal in your. 1. Stocks. Almost everyone should own stocks or stock-based investments like exchange-traded funds (ETFs) and mutual funds (more on those in a. After you've put a little effort into it, you can feel really good about investing, especially when things go well. ways to sell and get your money? Do. Top 10 Tips for First time investors · 1. Establish a Plan. A to B · 2. Understand Risk. Investment Risk · 3. Be Tax Efficient from the Start. Tax Umbrella · 4.

Stocks, bonds and more: The building blocks of investing · stock · bond · cash equivalent · mutual fund · exchange-traded fund (etf) · Up Next. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». Best ways to invest your money · Insurance plans. These instruments are excellent for young beginners with a steady source of income. · Mutual funds. Mutual. shares - you buy a stake in a company · cash – the savings you put in a bank or building society account · property – you invest in a physical building, whether. If you make smart decisions, investing can be rewarding. Beyond making your money work harder, simply making good decisions can be satisfying. Investing that extra money may sound like a great idea, but where should you start? While investing always involves some risk, these tips and insights are based. funds to work in a savings or investment account. An unexpected windfall is full of possibility. But what's the best way to use extra cash? Wherever your. For those wanting a more hands-on experience with their investment, ETFs are a great way to start. Unlike mutual funds, there is no minimum dollar amount to. A custodial account can be a great way to save on a child's behalf, or to give a financial gift. Basically, these are easy-to-open accounts used to invest in. 5 types of low-risk investments · 1. Treasury bills, Treasury notes and TIPs · 2. Fixed annuities · 3. Money market funds · 4. Corporate bonds · 5. Series I savings. It's one of the best ways to meet your financial goals. 3 keys to investing All investing is subject to risk, including the possible loss of the money you. 1. Invest early Starting early is one of the best ways to build wealth. Investing for a longer period of time is widely considered more effective than waiting. Funds are pooled instruments managed by investment managers that enable investors to invest in stocks, bonds, preferred shares, commodities, etc. Two of the. Schwab Intelligent Portfolios® is investing made easy. Our robo-advisor builds, monitors, and rebalances a diversified portfolio of exchange-traded funds. Mutual funds and exchange-traded products (ETPs) are additional ways to invest in securities. And never stop educating yourself about investing! Back to Top. It takes planning and commitment and, yes, money. Facts. ▫ Only about half Put your savings in different types of investments. By diversifying this. Cash. Includes bank accounts, high interest savings accounts and term deposits. Used to protect wealth and diversify a portfolio. Average return over last Investing is an effective way to put your money to work and potentially build wealth. good fit for your needs. Learn about investment types >. Products. Best ways to invest your money · Insurance plans. These instruments are excellent for young beginners with a steady source of income. · Mutual funds. Mutual. The two major ways funds may be offered are (1) by companies in the Top 10 holdings - Ten largest holdings in a portfolio based on asset value.